Our history

NorthRow wasn’t just about the business opportunity, but a chance to make a difference to the devastating effects that fraud, and other forms of financial crime, can have across the world today.

Founded in 2010

How it all began

NorthRow (formerly Contego) was founded by Adrian Black to enable organisations to combat fraud and financial crime. NorthRow wasn’t just a business opportunity for Adrian, but a chance to make more of a difference to the catastrophic effects that fraud and other forms of financial crime can have on individuals and companies.

Raised seed funding in 2011

Foundations put in place for growth

Through seed funding, NorthRow grew quickly developing onboarding solutions for clients across multiple industries including Fintech, Serviced Offices and the Property Sector.

Winning new business in 2012

First major account win

We partnered with Regus Plc as a result of working with law enforcement and being a preferred supplier to the Business Centre Association. Delivering a range of regulatory services to Regus started our evolution into a RegTech business.

Achieved ISO27001 in 2013

Data security as standard

One of the first companies in the UK to achieve certification to the new ISO27001:2013 standards. High security and guaranteed compliance come as standard with NorthRow.

Selected for Accenture Fintech Lab in 2016

12-week programme to help refine our product

NorthRow was selected for the highly competitive 12-week programme that helped early to growth stage enterprise technology companies refine and test their value proposition with the support of the world’s leading financial service firms.

Cyber Essentials accreditation in 2016

Further improving our data security

NorthRow achieved the Cyber Essential Plus certification, a government-backed, industry-supported scheme to help organisations protect themselves against the increasing threat of cyber-attacks.

First international clients secured in 2016

Globalisation is at the forefront of our minds

After NorthRow successfully delivered client onboarding solutions for Regus UK, it was then rolled out internationally to chosen countries.

Maven leads £3.5m investment in 2017

Further funding to continue our growth

One of the UK’s leading private equity houses, Maven, led a £3.5 million Series A investment in NorthRow, to support the continued growth, expanding product development, adding commercial resources, and entering new markets.

Partnered with Open Banking in 2017

Delivering world-leading checks to Open Banking

Open Banking chose NorthRow to deliver their onboarding processes, as they set the standard for securely managing customer financial data.

Launched Managed Service in 2017

Identity verification at it's very best

We launched a fully managed service to provide identity verification to government best practice standards.

Launched Working Status app in 2017

Right-to-Work checks just became easy

We launched an easy-to-use app that enables employers to perform Right-to-Work verification checks, from anywhere at any-time with latest biometric facial recognition technology.

Launched PEPs & Sanctions Monitoring in 2018

PEPs and Sanction monitoring comes to NorthRow

We launched international company data and monitoring functionality allowing clients to onboard to expand their global business reach, whilst maintaining compliance.

Launched Amber Management strategy in 2019

Streamlined our 'Amber' compliance check

We made it our mission to reduce ‘Amber’ inconclusive compliance checks for our customers, so that they can more quickly just get on with doing what they do best.

RemoteVerify comes to NorthRow in 2019

Remote onboarding using their own device, anywhere, at any time

We developed RemoteVerify so that clients could be signed up and verified from anywhere at anytime, whilst delivering regulatory compliance.

API v3 introduced in 2020

Integration, integration, integration

We upgraded our API architecture to bring better automation and allow more efficient access to client information which will allow you to improve your customer experience.

DCMS certification granted

NorthRow becomes a government certified Identity Service Provider

Our WorkingStatus app receives government approval as IDVT technology that enables businesses to remotely onboard new employees in real time.

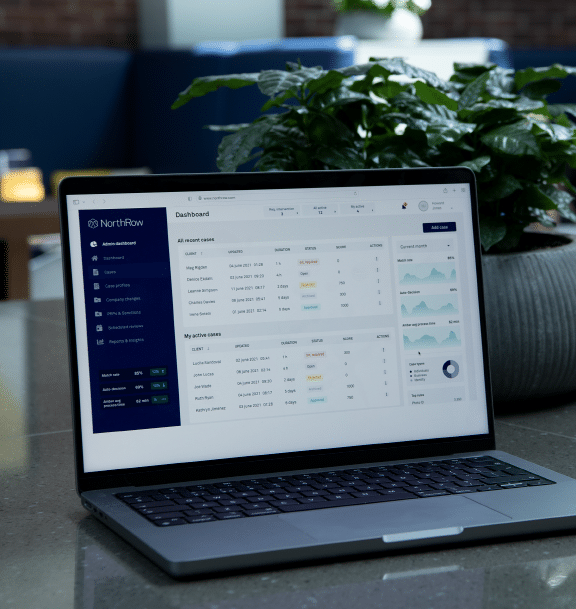

WORKSTATION COMES TO THE MARKET IN 2022

Case management simplified with our new compliance platform

From a single platform, users can access client-led configurable automation designed to help compliance teams with digital transformation, from streamlining their processes to enhanced visibility at scale.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution today and be part of our journey to fight financial crime.