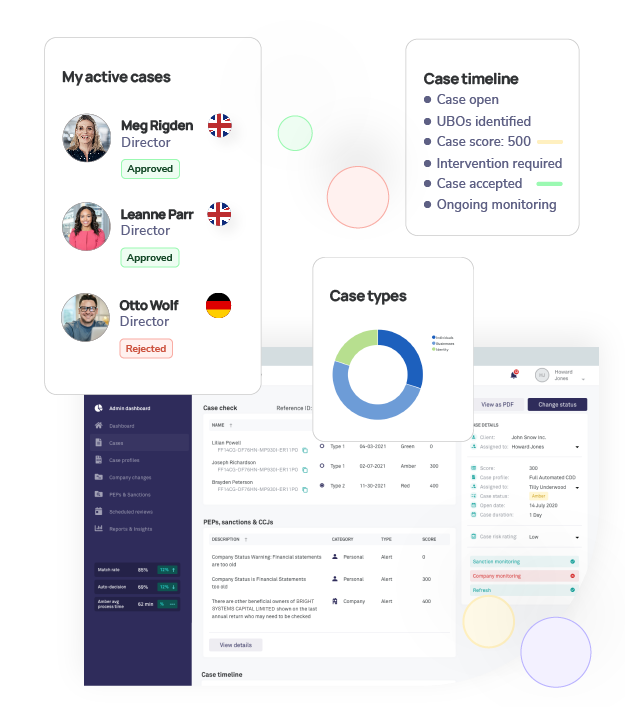

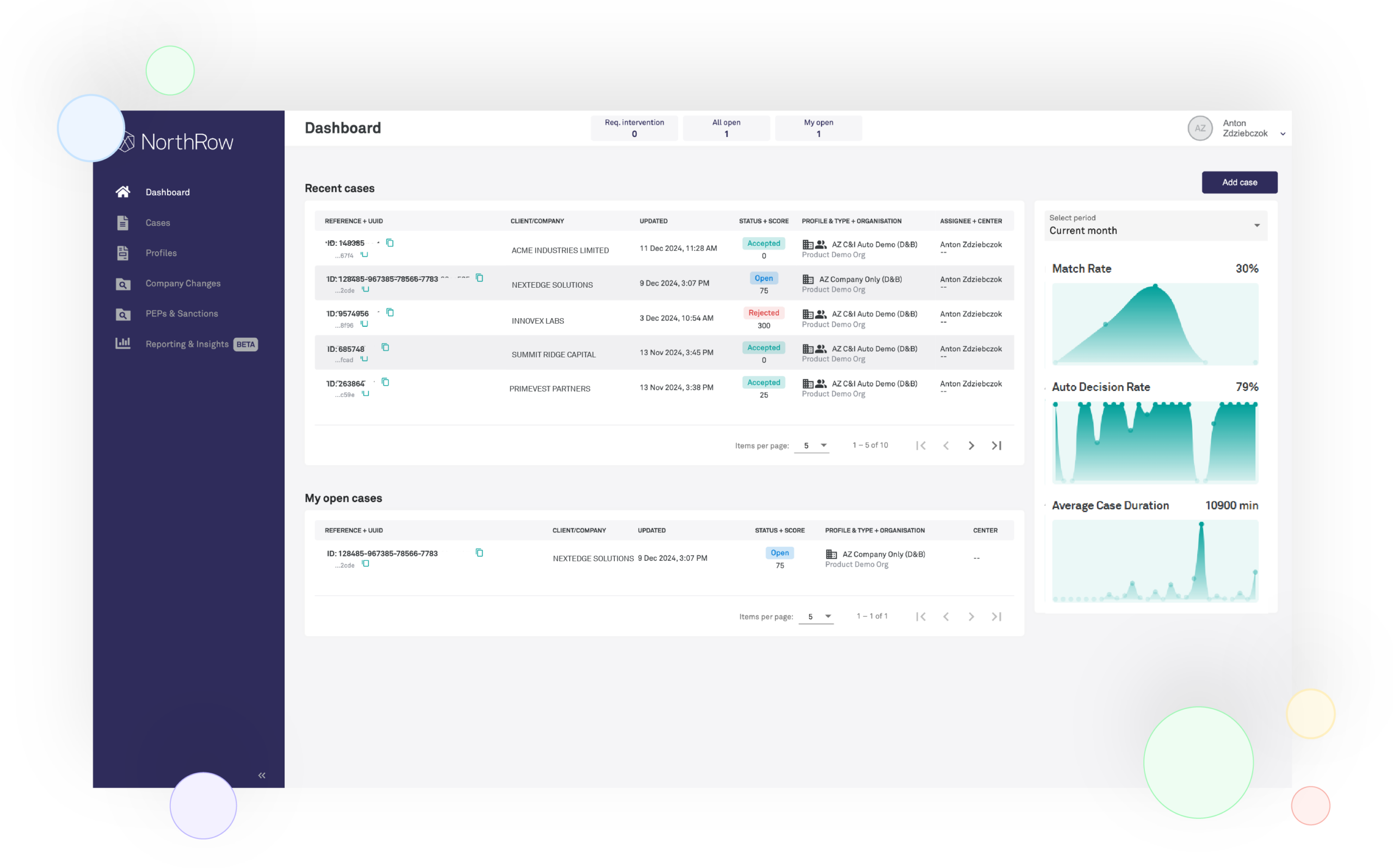

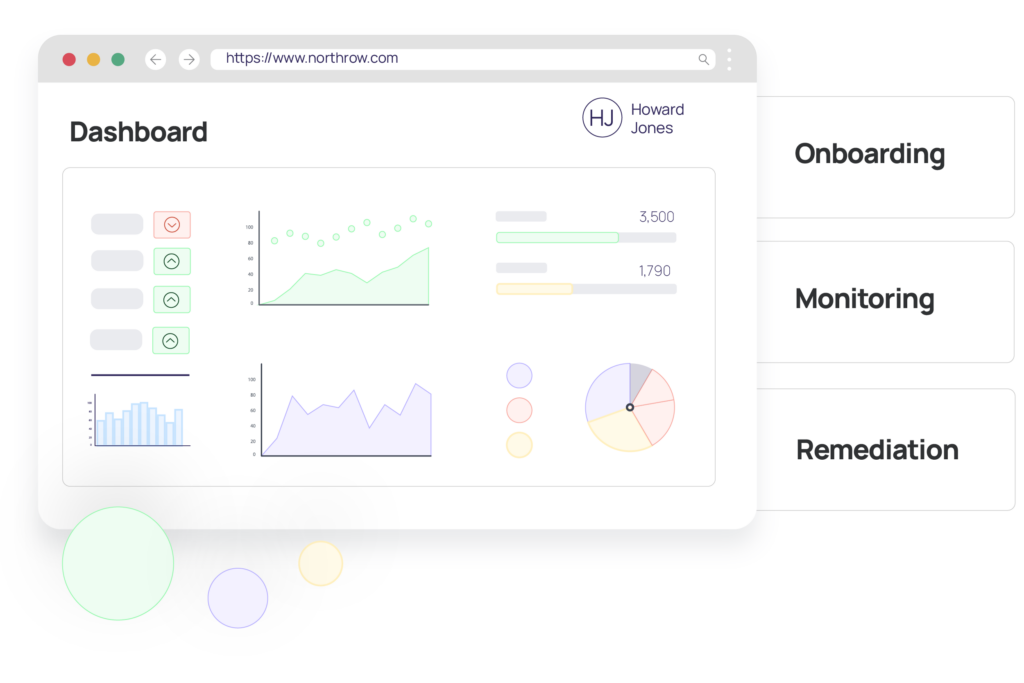

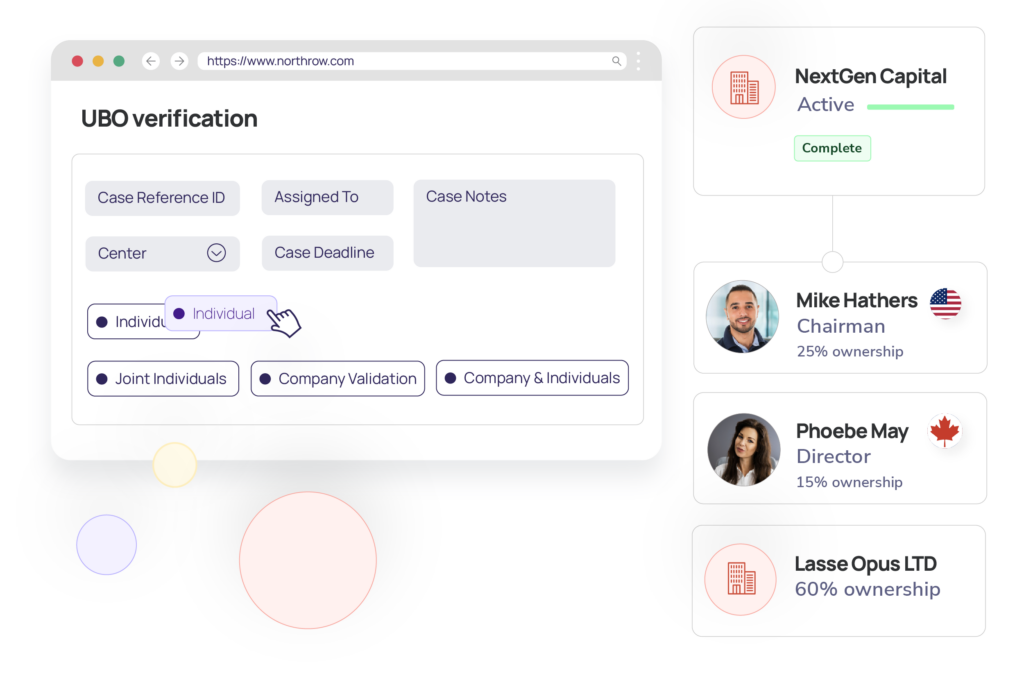

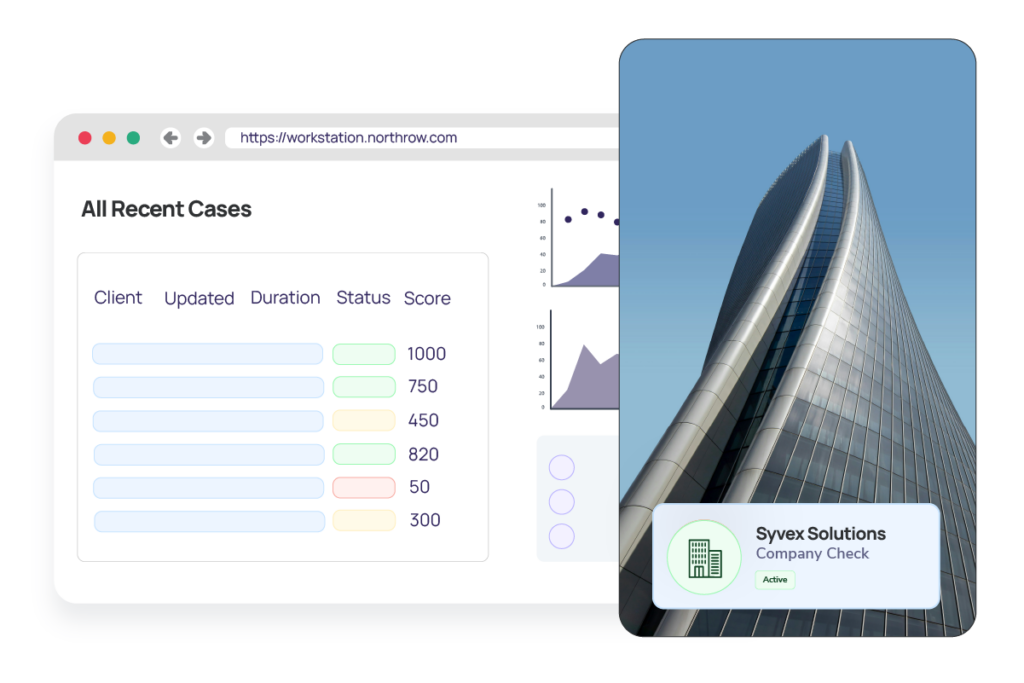

End-to-end AML compliance management

Meet WorkStation, a global AML platform giving you peace of mind.

Effortlessly manage KYB, KYC, and ID verification, backed by global data coverage – ensuring faster onboarding, smarter risk detection, and full compliance, no matter where you operate.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive