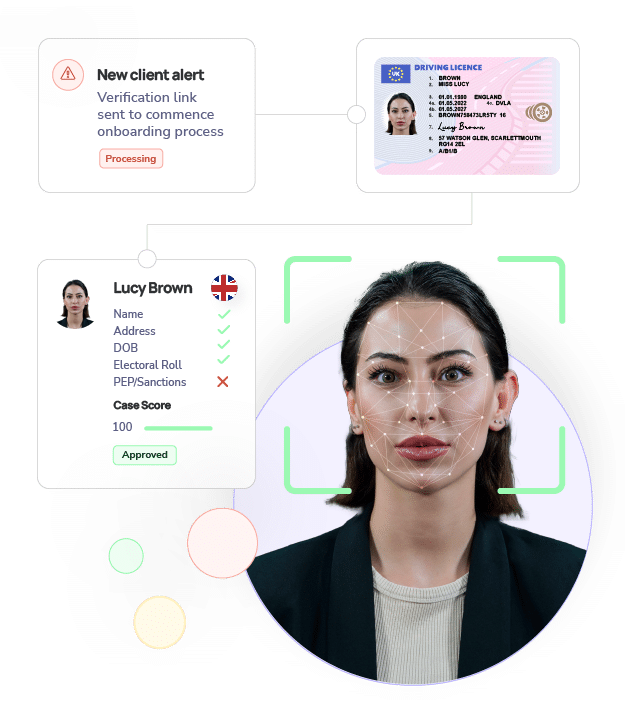

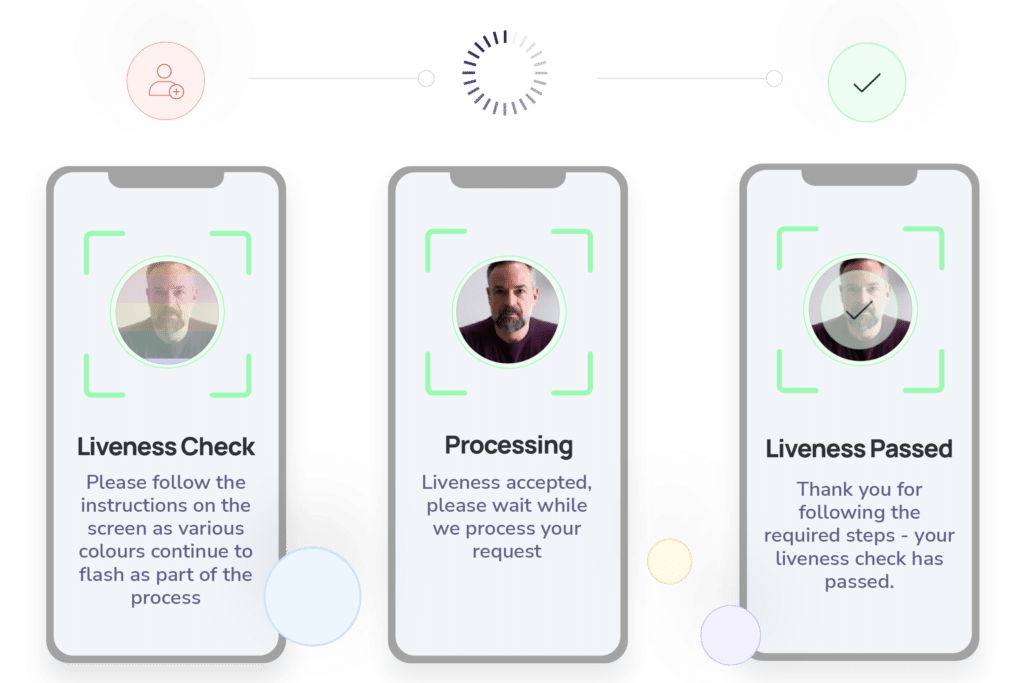

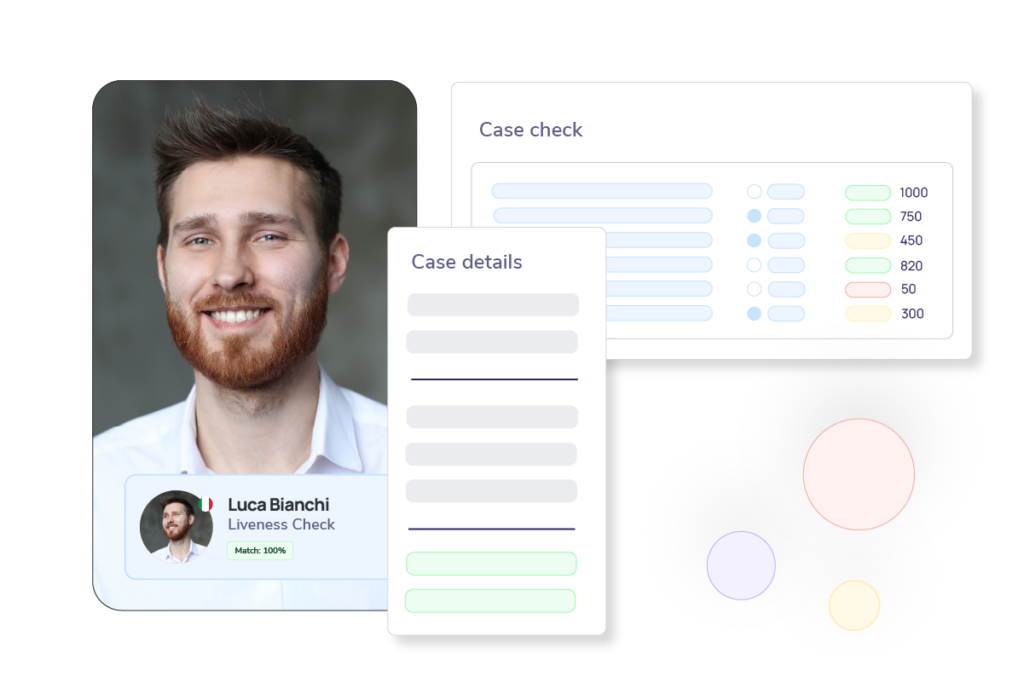

RemoteVerify for ID&V checks

Instant identity verification for fast, compliant onboarding

Allow customers verify their identities quickly and accurately, cutting down onboarding time and strengthening your compliance. With RemoteVerify, users can complete sign-up and verification in minutes – anytime, anywhere, right from their own device.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive