Biometric authentication software

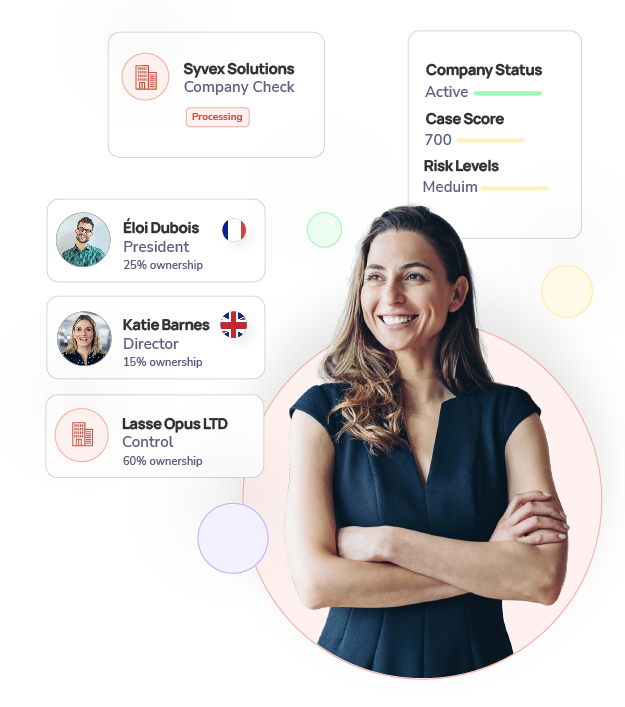

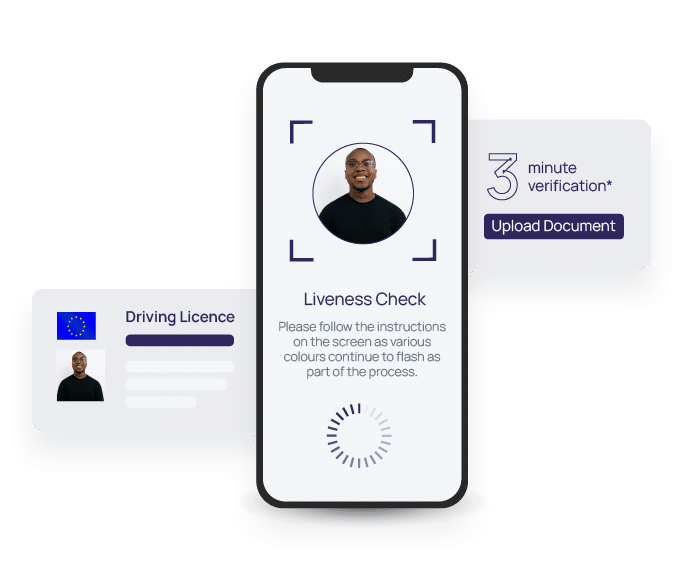

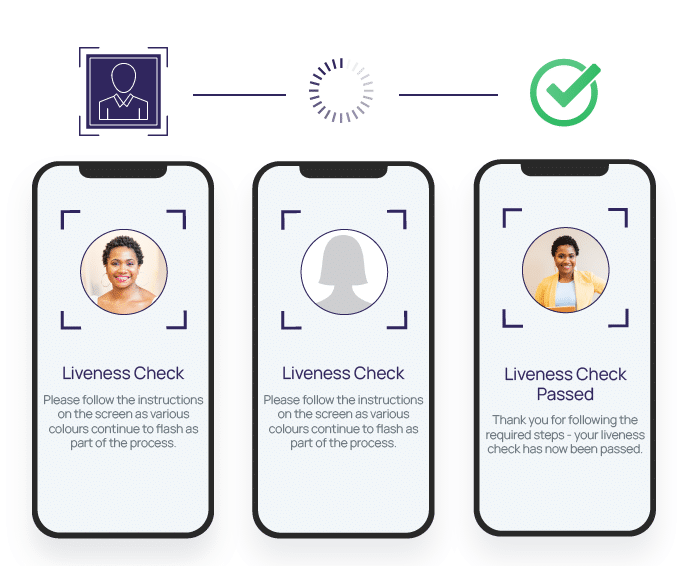

Fast, reliable biometric authentication for KYC, KYB, and UBO compliance.

Accurate, secure biometric authentication for identity verification. Whether you’re conducting KYC checks for individuals or handling KYB and UBO verification for corporate clients, you can ensure compliance, mitigate fraud risks, and provide a seamless user experience.

Request Demo