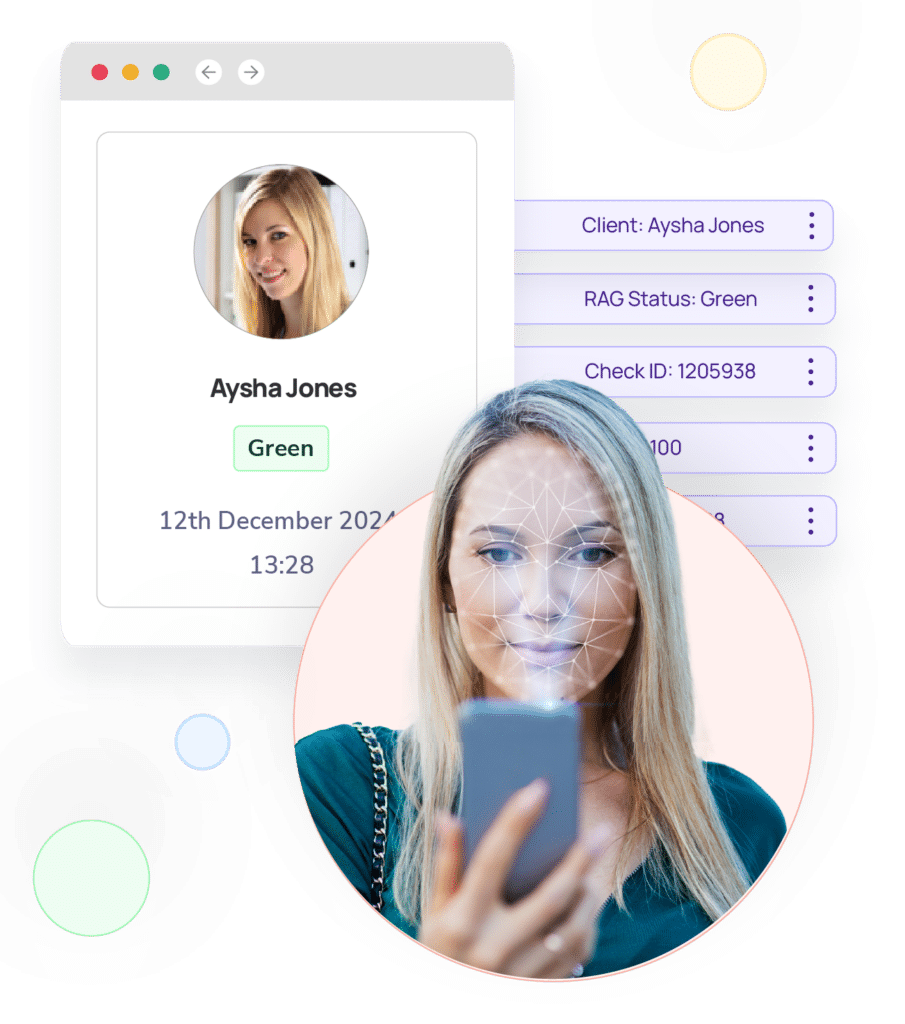

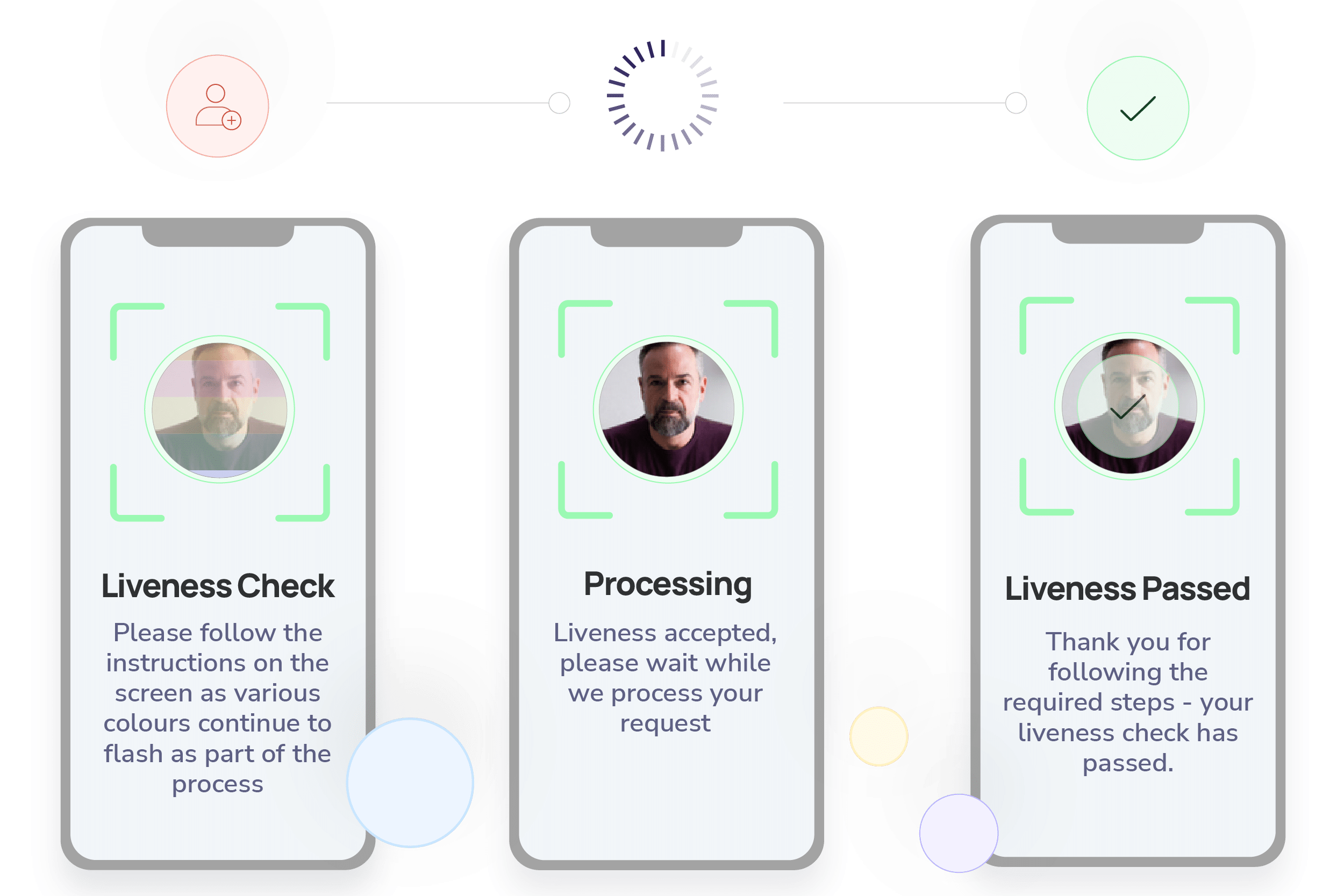

Identity and verification (ID&V) software

Streamline client onboarding with fast, secure ID&V checks.

Verify client identities instantly, reduce fraud risks, and conduct comprehensive checks, including PEPs, sanctions, and adverse media screening – all in one seamless solution.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive