AML compliance for the art market

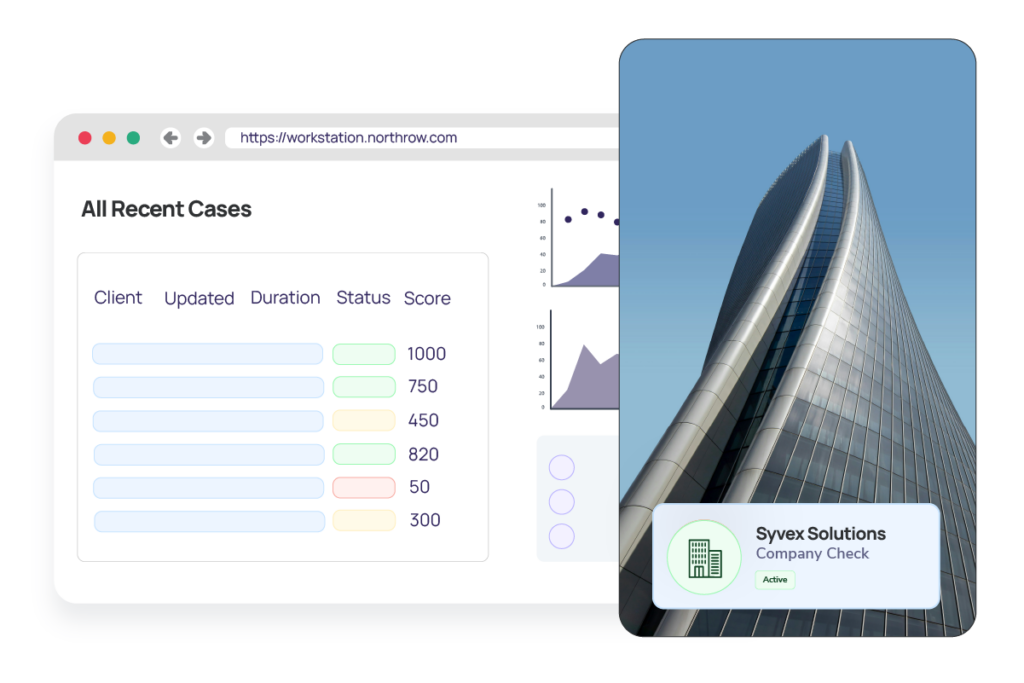

Gain transparency high-value deals and intermediary risks

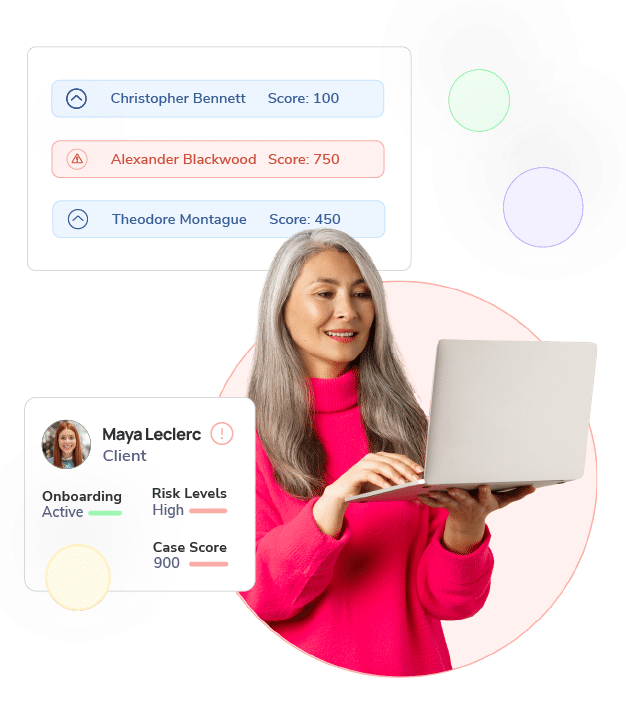

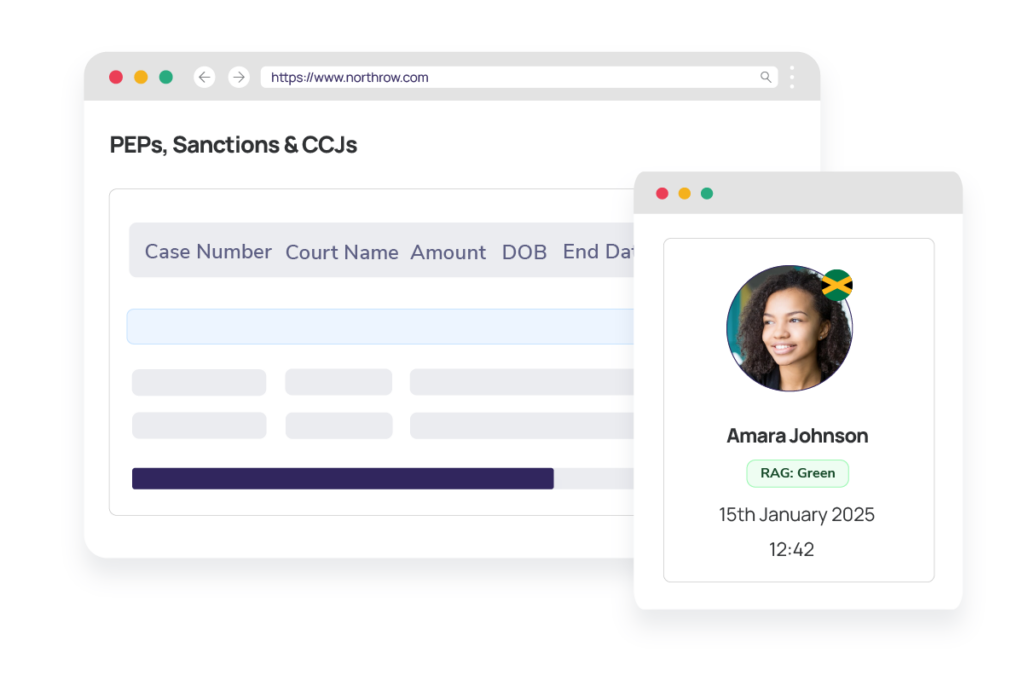

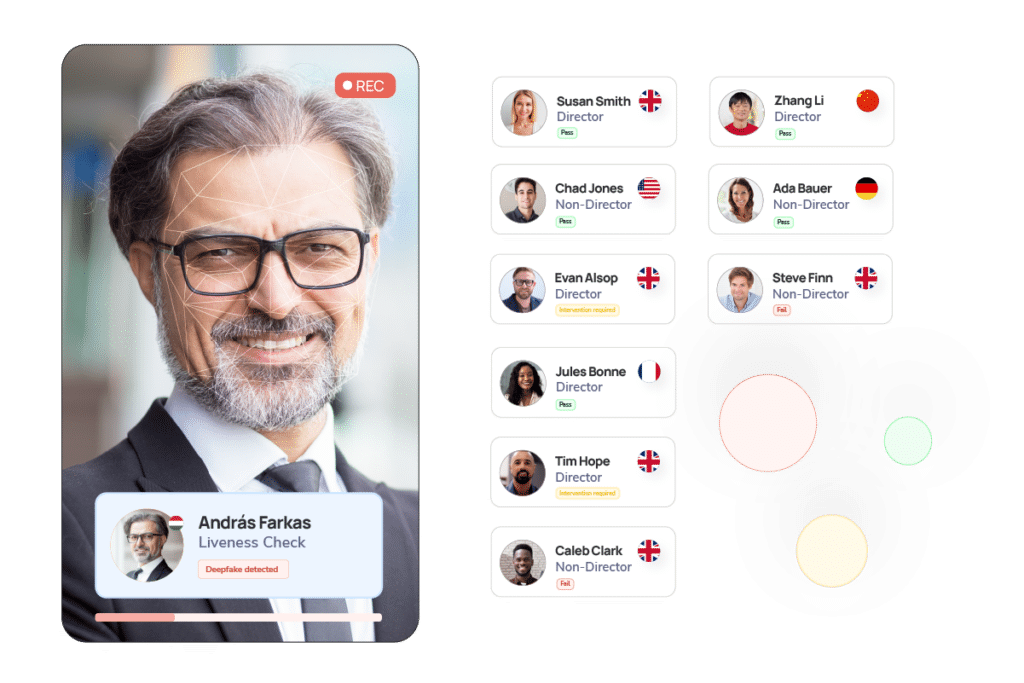

Simplify the customer verification with automated CDD/KYC processes. Instantly verify the identity of buyers and sellers, run PEP and sanction checks, and assess risk levels in real-time.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive