eKYC stands for electronic Know Your Customer and refers to the digital process of remote, paperless process that minimises the costs and traditional bureaucracy necessary in KYC checks. eKYC uses digital identification processes with the aid of technology such as AI (e.g. … Read More

Author Archives: Lauren Davison

8 benefits of AML & KYC compliance software

Regulatory compliance is a business’s adherence to regulations, laws, guidelines and specifications relevant to its day to day business activities and processes. Failing to comply with these requirements can result in legal fines, loss of reputation, down time and loss of productivity, as well as imprisonment in some cases. … Read More

Why is the KYC process important?

KYC (Know Your Customer) processes are the fundamental building blocks of any regulated entity’s AML (Anti-Money Laundering) process. Being confident that you know who you are doing business with, from day one of the relationship, is the first step to … Read More

What is the difference between a Beneficial Owner and an Ultimate Beneficial Owner of a company?

What is a Beneficial Owner of a company? Beneficial ownership is distinguished from legal ownership, though in most cases, the legal and beneficial owners are one and the same. Legally, an ownership can be classified into two; (1) legal and … Read More

What is a PEP & should you work with them?

In the world of finance, the term “PEP” holds a significant weight. But what exactly is a Politically Exposed Person (PEP), and why should you be concerned about working with them? PEPs are high-ranking public officials who are vulnerable to … Read More

This Month in Compliance: July 2022

Each month, we take a look at the latest compliance news and insights to keep you on top of what you need to know from across the industry. In July, momentum continued to gather behind the ‘metaverse’. At Money 20/20 … Read More

What is KYC remediation?

Know Your Customer (KYC) is the process of verifying your customer’s identity, usually using compliance solutions and screening software. The goal is to identify the clients that are most at risk of financial crime. Verifying the identity of someone you … Read More

Beneficial Ownership Monitoring is Fundamental for Global Economic Recovery

How well do you know your customer? As the pandemic continues on a global level, your clients’ risk status is changing at unparalleled speed. Effective ‘continuous KYC monitoring’ is essential for Compliance Officers if they want to stay ahead of the criminals. In 2020 firms have made significant investments in digitally transforming the front end of compliance at the point of onboarding, however many firms have not digitally transformed their monitoring processes, exposing their business to increasing levels of risk. In this blog we explore ongoing monitoring further. … Read More

NorthRow Appoints New CEO for the Next Stage of Growth

Adam Holden appointed as new Chief Executive Officer at NorthRow. Adam will oversee our next stage of growth trajectory. Learn more. … Read More

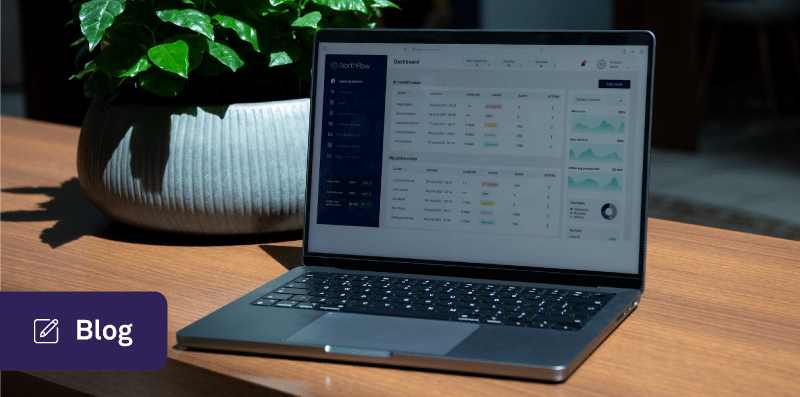

Automated Client Onboarding

Efficient and ‘friction-free’ client onboarding is the key to customer engagement for any regulated business, but the need to balance this against the demands of the regulators is critical. … Read More