Efficient AML checks for estate agents

Provide a friction-free experience for your clients with digital onboarding, whilst maintaining compliance, allowing you to focus on growing your business.

How NorthRow helps estate agents achieve AML compliance

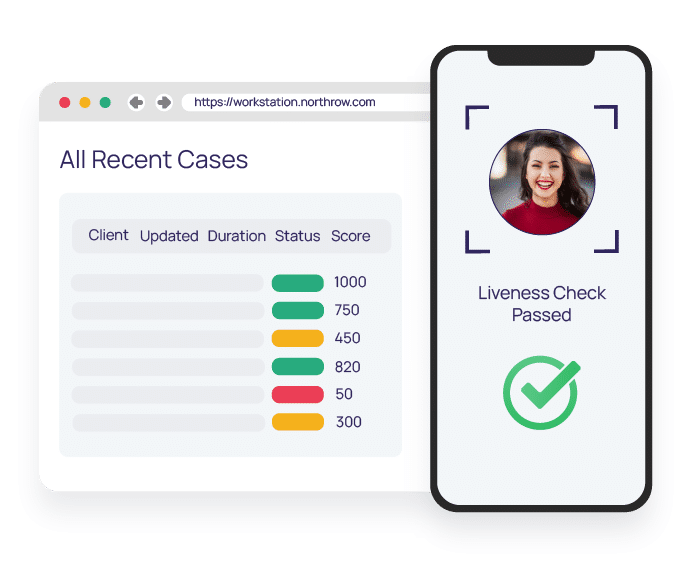

Real-time case results

AML checks for estate agents delivered in seconds rather than days allowing you to onboard new client's safely and quickly.

Reduced abandonment

Improved and faster onboarding to achieve improved customer satisfaction and reduced friction-free processing.

Compliance consistency

Use automated processes to reduce human error, comply with changing financial regulations and a consistent approach for auditing.

Ensure your reputation is solid

Meet compliance regulation to avoid reputational damage to your company's brand and avoid hefty fines that can be imposed.

Estate agents and their KYC, KYB and due diligence

First line of defence for AML compliance for estate agents

Estate agents are the first line of defence for AML compliance and can avoid being the target of fraudsters. NorthRow enables Estate agents to quickly identify and verify individuals and businesses to ensure that their clients are who they say they are.

KYC for estate agents

Know your customer identification

Reduce costly manual AML checks for your estate agency with a single platform to electronically verify your customers in real-time.

KYB for estate agents

Know your business verification

Efficient business onboarding. We help estate agents and property developers meet their KYB and AML obligations. WorkStation will screen and identify financial and shareholder information as well as UBO details for the most complex corporate structures.

Due diligence for estate agents

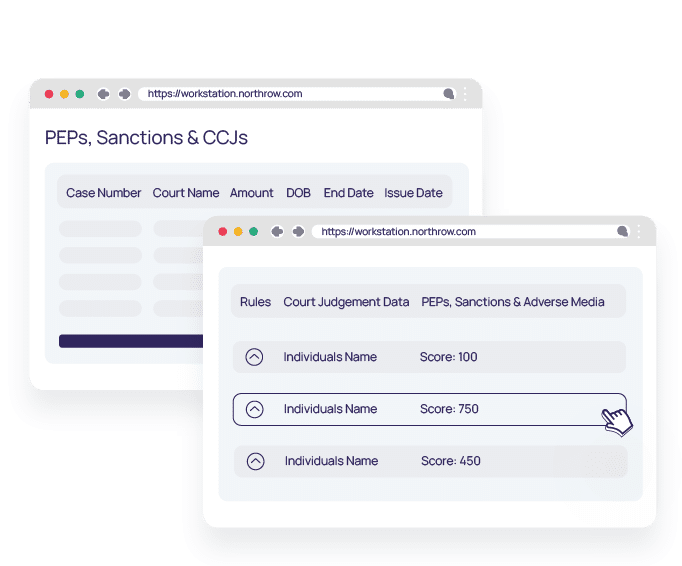

Screening and enhanced due diligence

Ongoing screening for PEPs, sanctions and adverse media in real-time is essential to meet AML requirements. Estate agents use WorkStation to screen against sanctions and global watchlists from a wide range of data sources from one single platform.

“

"...there has been a positive change towards client onboarding. We have seen a significant improvement from a cost and time perspective. "

Deputy Money Laundering Officer

Knight Frank

Why NorthRow...

500k+ worldwide users

173 active countries

99.99% uptime

The easiest way to perform AML checks for estate agents is to use NorthRow's WorkStation platform for digital verification and ongoing monitoring.

WorkStation verifies, screens, manages the results, monitors and provides a record of all transactions for audit purposes. As a single platform it delivers all your KYC, KYB and ongoing monitoring in an intuitive end-to-end solution.

KYC and KYB Screening

Facilitate the complexity of compliance and reduce risk when onboarding new clients by verifying their identity and screening against sanctions lists.

Case

management

Manage each individual and company with our simple case management solution, view results and set alerts where action is required to ensure due diligence.

ID&V and Right to Work

Simplify ID&V with an easy-to-use case system which allows you to organise, update, and store information securely, and in line with GDPR and data protection regulations.

AML compliance

Keep track of your clients’ risk status using our RAG system and be alerted to any relevant changes, ensuring you meet ongoing AML compliance.

Ongoing monitoring

Automated alerts notify companies and individuals of risk profile changes, so you can keep tabs on political exposure, sanctions or adverse media.

Remediation

Improve efficiency with a risk-based approach to remediation and data collection processes minimising the administrative burden placed on your team.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution for estate agents today.