Navigating risk for wealth management firms

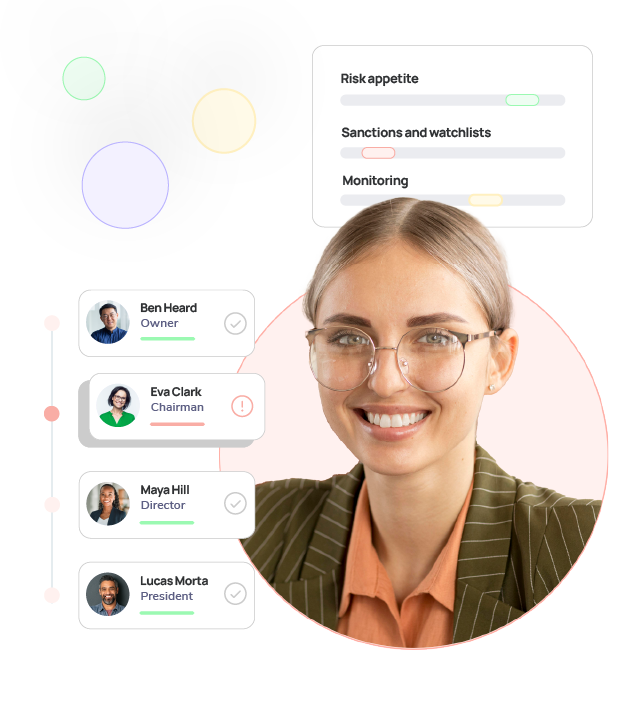

Manage complex client risk profiles for HNW and UHNW individuals

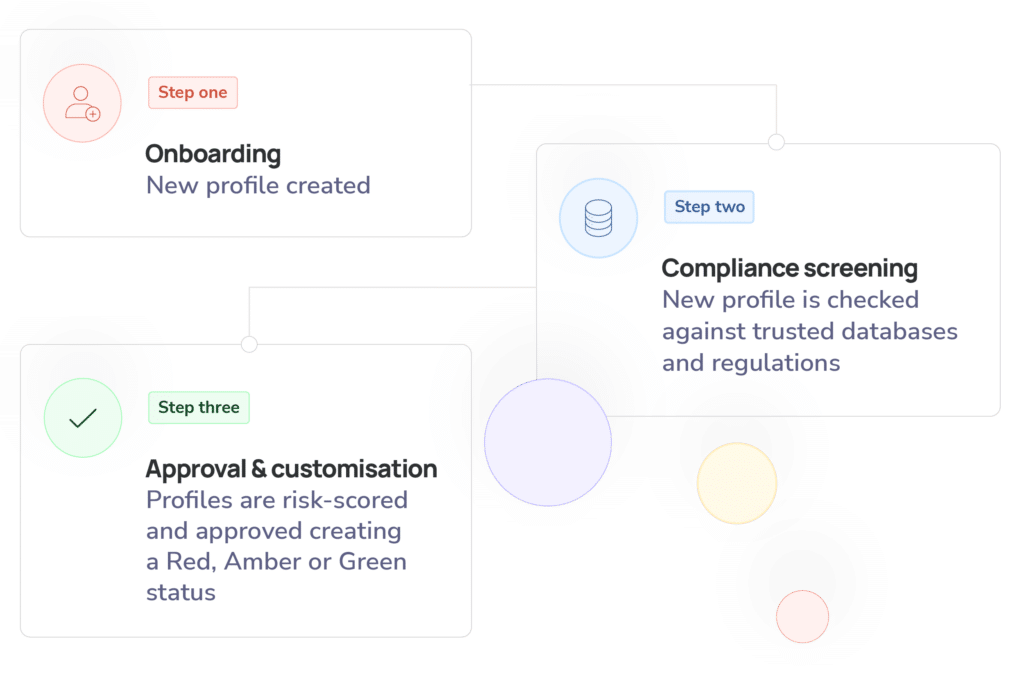

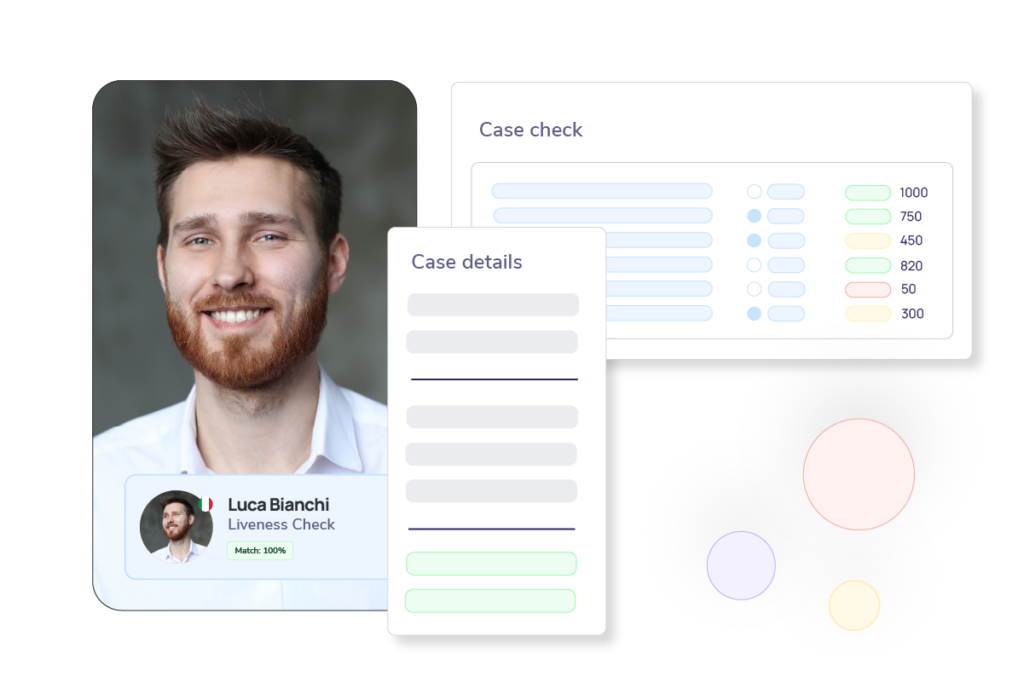

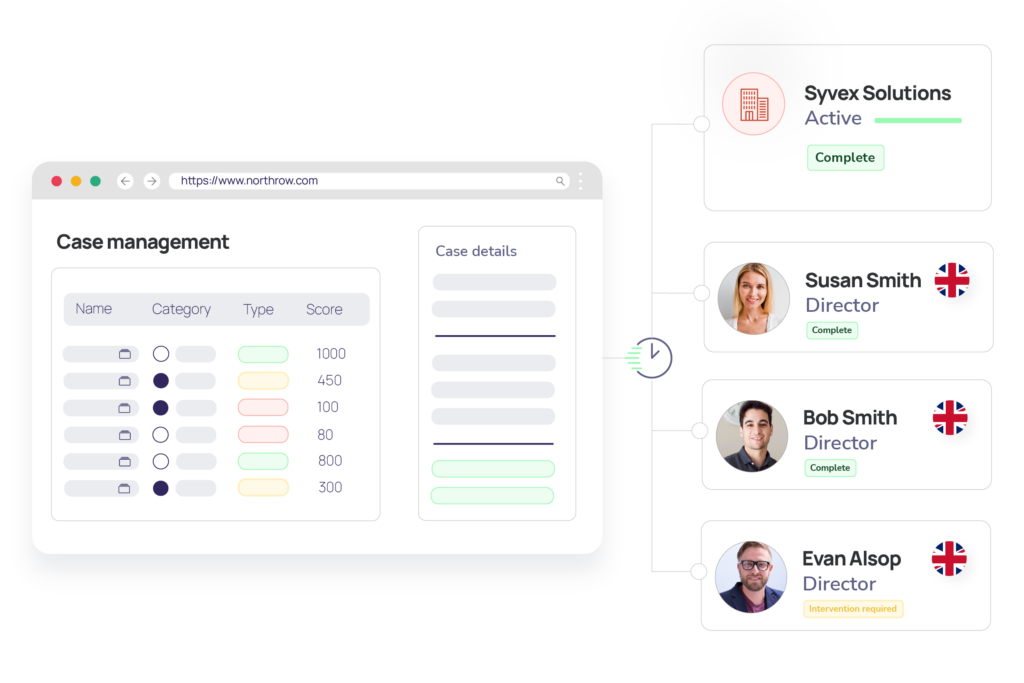

Conquer complex corporate structures that make assessing and monitoring risk highly challenging. Implement dynamic AML processes to ensure ongoing due diligence, accurate risk assessments, and compliance with global regulations.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive