cross-border compliance for venture capital firms

Overcome cross-border compliance and beneficial ownership

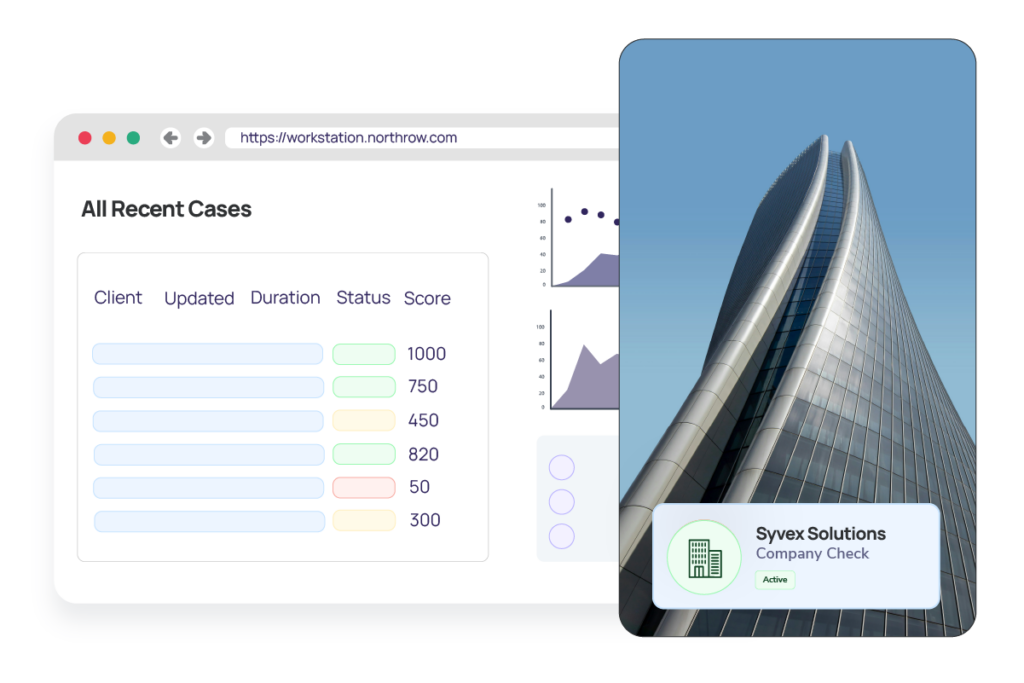

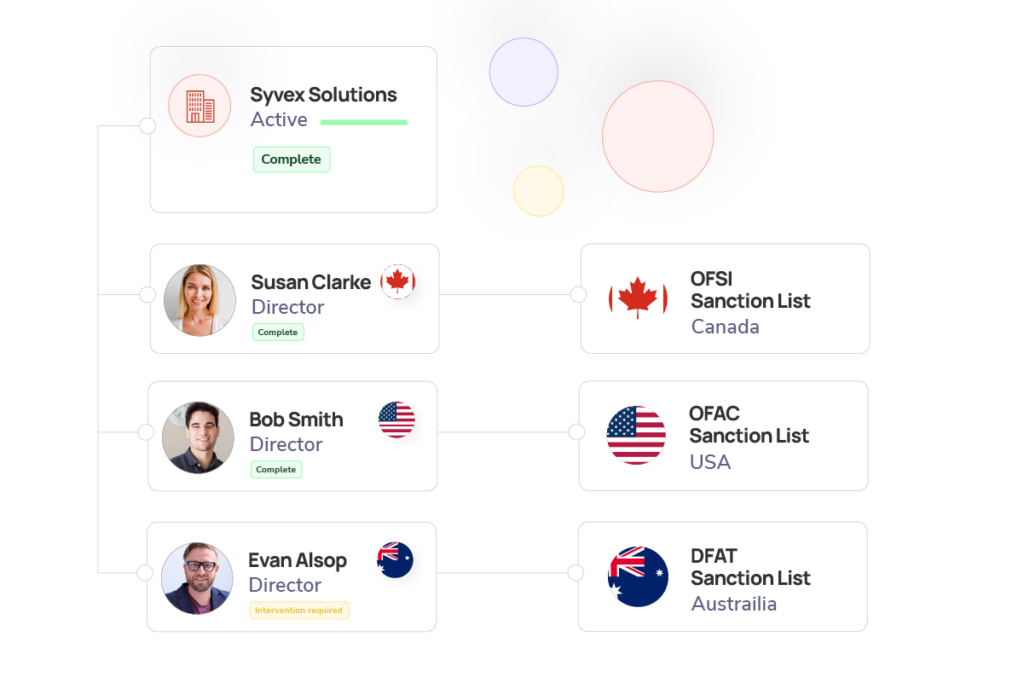

Automatically and efficiently screen investors, investees, and partners against global watchlists, sanctions, PEPs, and adverse media, with instant and reliable flagging of high-risk individuals or entities.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive