Reduce telecoms fraud and ensure KYC verification

Provide a friction-free experience for your clients with digital onboarding, whilst maintaining compliance, allowing you to focus on growing your business.

How NorthRow helps telecoms firms

Reduce risk of SIM card fraud

Use biometric facial recognition to onboard new customers quickly and safely, ensuring the customer is who they say they are.

Target payment scams head on

Robust KYC processes that protect mobile operators and telecoms firms from being used for money laundering and terrorist financing.

Powerful identity verification

Staying ahead of your competitors with fast onboarding whilst protecting your business, will support your business growth.

Ensure your reputation is solid

Meet compliance regulation to avoid reputational damage to your company's brand and avoid hefty fines that can be imposed.

KYC, KYB and due diligence for TELECOMS FIRMS

Protect your telecoms firm from financial crime

Telecommunications companies are increasingly finding themselves vulnerable to fraud. Activities can include SIM card fraud, payment scams and fake identities. With fraudsters hiding their wealth or financing illegal activities, telecoms companies must act on money laundering and fraud activities now.

KYC checks for telecoms firms

Know your customer identification

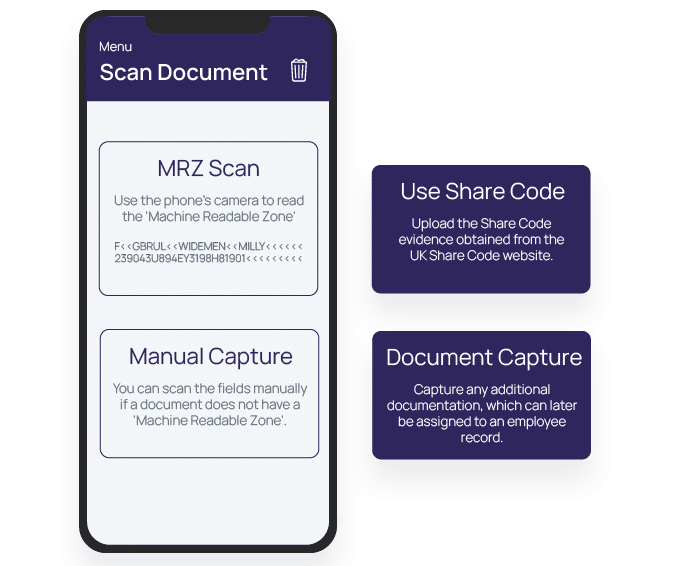

To combat increasing levels of fraud within telecoms, mobile operators must look to ensure identity verification when onboarding customers. WorkStation, our AML software delivers automated KYC from anywhere and reduces time-consuming, inconsistent, resource heavy manual checks.

ID&V for telecoms firms

Identity document verification

WorkStation uses verification data from leading sources to ensure telecoms businesses reduce their chance of approving fraudulent documents. With ongoing monitoring that provides real-time updates and alerts, telecoms businesses can be confident in fighting the war on financial crime.

KYB for telecoms firms

Know your business verification

Improve the average onboarding time of your business customers from days to hours, and reduce abandonment rates. A frictionless experience from one single solution delivers complete KYB verification.

“

"By partnering with NorthRow, we have achieved peace-of-mind in performing routine verification when welcoming new customers."

Michelle Valentine, UK Operations Director

Regus

Why NorthRow...

500k+ worldwide users

173 active countries

99.99% uptime

Whilst telecoms companies are not regulated for KYC and AML, they do have a moral obligation to fight the increasing levels of telecoms fraud. Customers are reassured by companies that take measures to protect them, and combat fraud and other forms of financial crime.

Stay ahead of your competitors and take a stance to combat crime with NorthRow’s automated digital verification solutions.

KYC and KYB screening

Facilitate the complexity of compliance and reduce risk when onboarding new clients by verifying their identity and screening against sanctions lists.

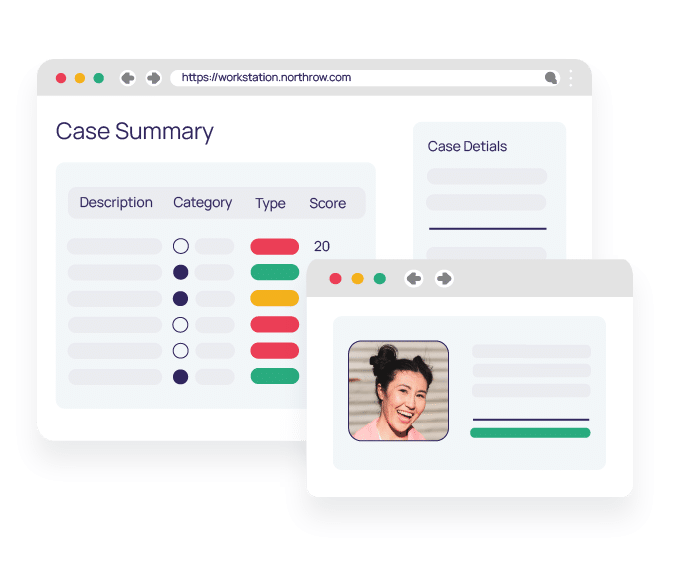

Case

management

Manage each individual and company with our simple case management solution, view results and set alerts where action is required to ensure due diligence.

Remote identity verification

Simplify ID&V with an easy-to-use case system which allows you to organise, update, and store information securely, and in line with GDPR and data protection regulations.

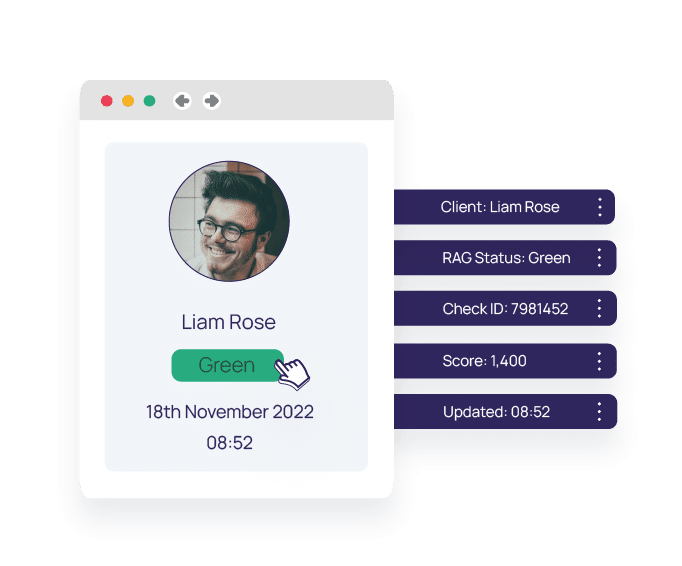

AML compliance

Keep track of your clients’ risk status using our RAG system and be alerted to any relevant changes, ensuring you meet ongoing AML compliance.

Ongoing monitoring

Automated alerts notify companies and individuals of risk profile changes, so you can keep tabs on political exposure, sanctions or adverse media.

Remediation

Improve efficiency with a risk-based approach to remediation and data collection processes minimising the administrative burden placed on your team.

Ready to get started?

Book your free demo of our comprehensive telecommunications AML software today.