Tackling AML and KYC in lending

Optimising onboarding to address client risk and fraud prevention

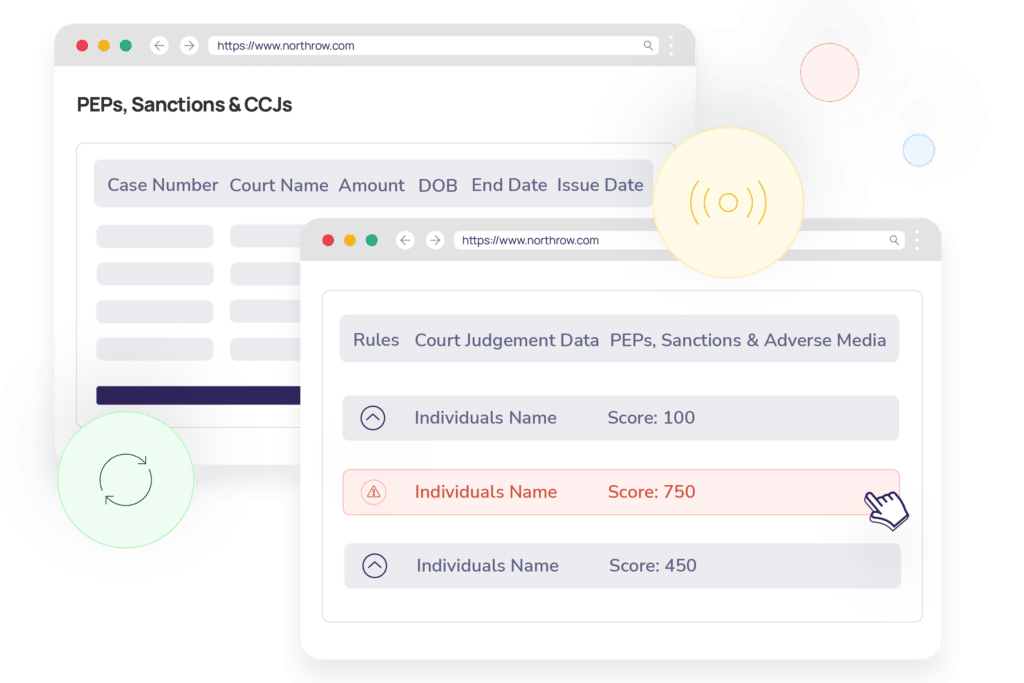

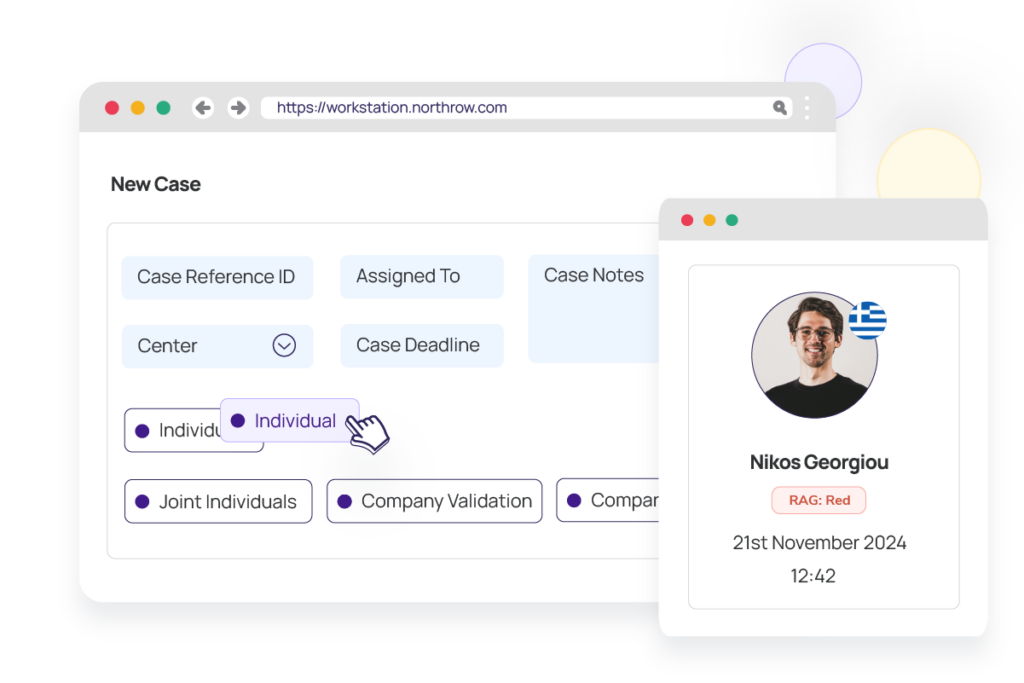

Integrate seamless verification checks that enable lenders to conduct thorough due diligence efficiently. This approach helps identify potential risks early in the onboarding process, facilitating informed decision-making.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive