Mitigating risks for retail

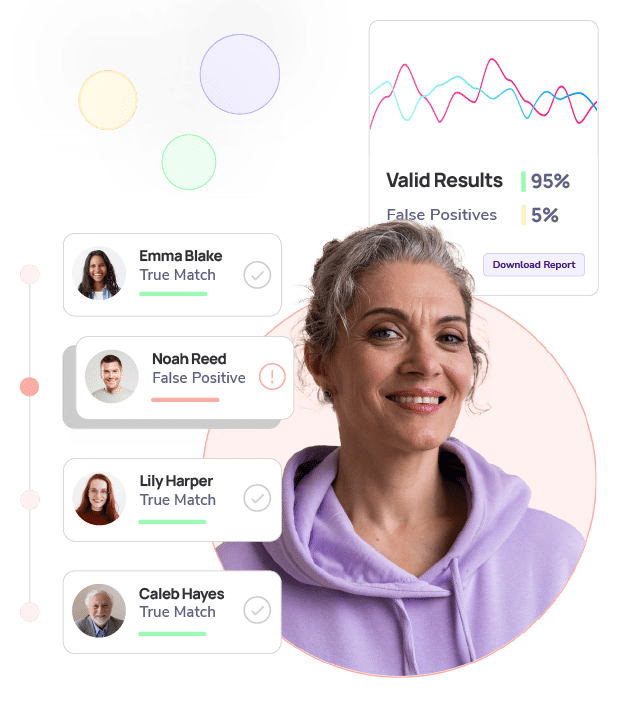

Manage suspicious activity and minimise false positives

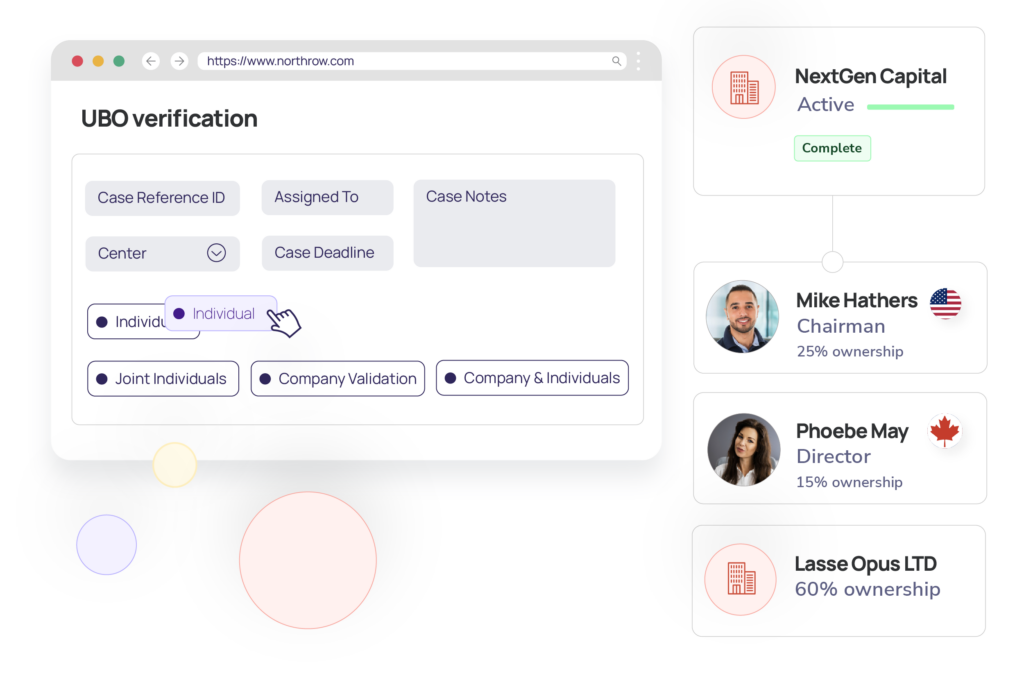

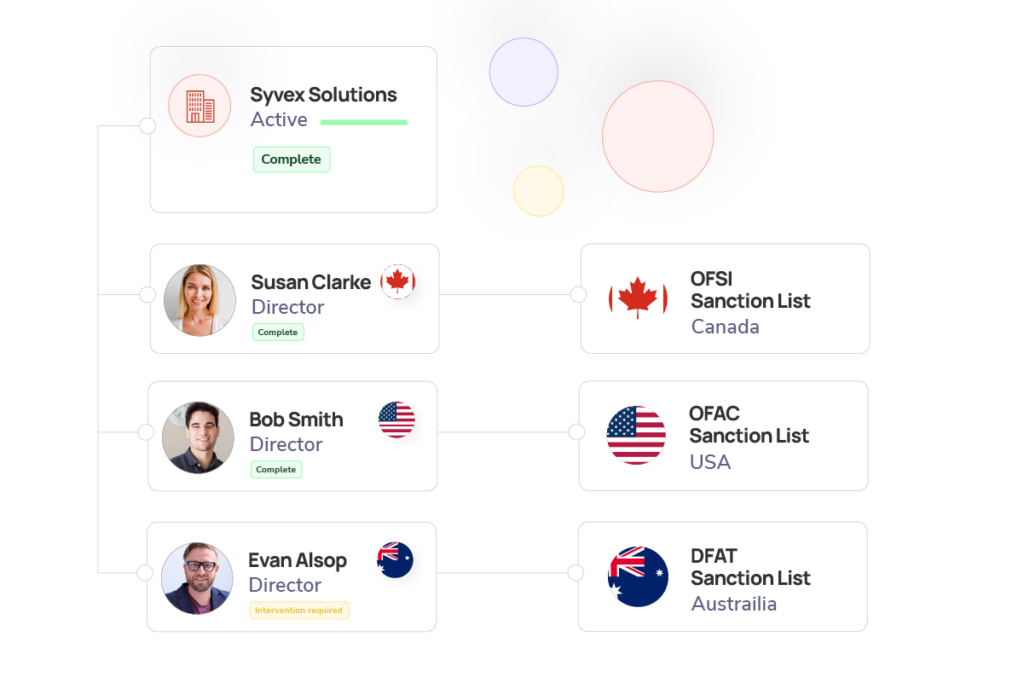

Understand and identify potential red flags, stay informed about geographic warnings, and implement a robust compliance program to effectively mitigate financial, operational, and repetitional risks.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive