- AML, ID Verification, KYB, KYC, UI

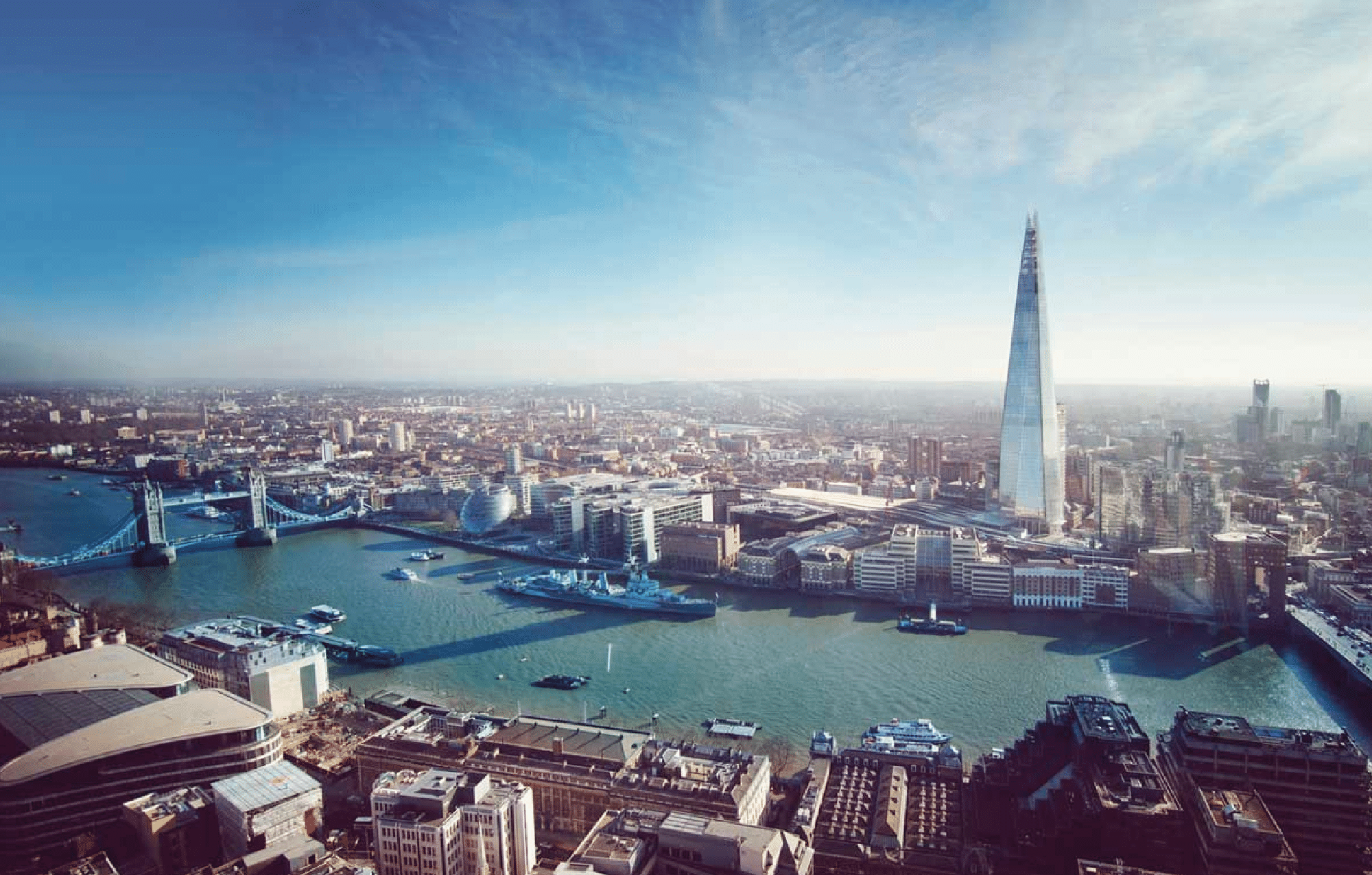

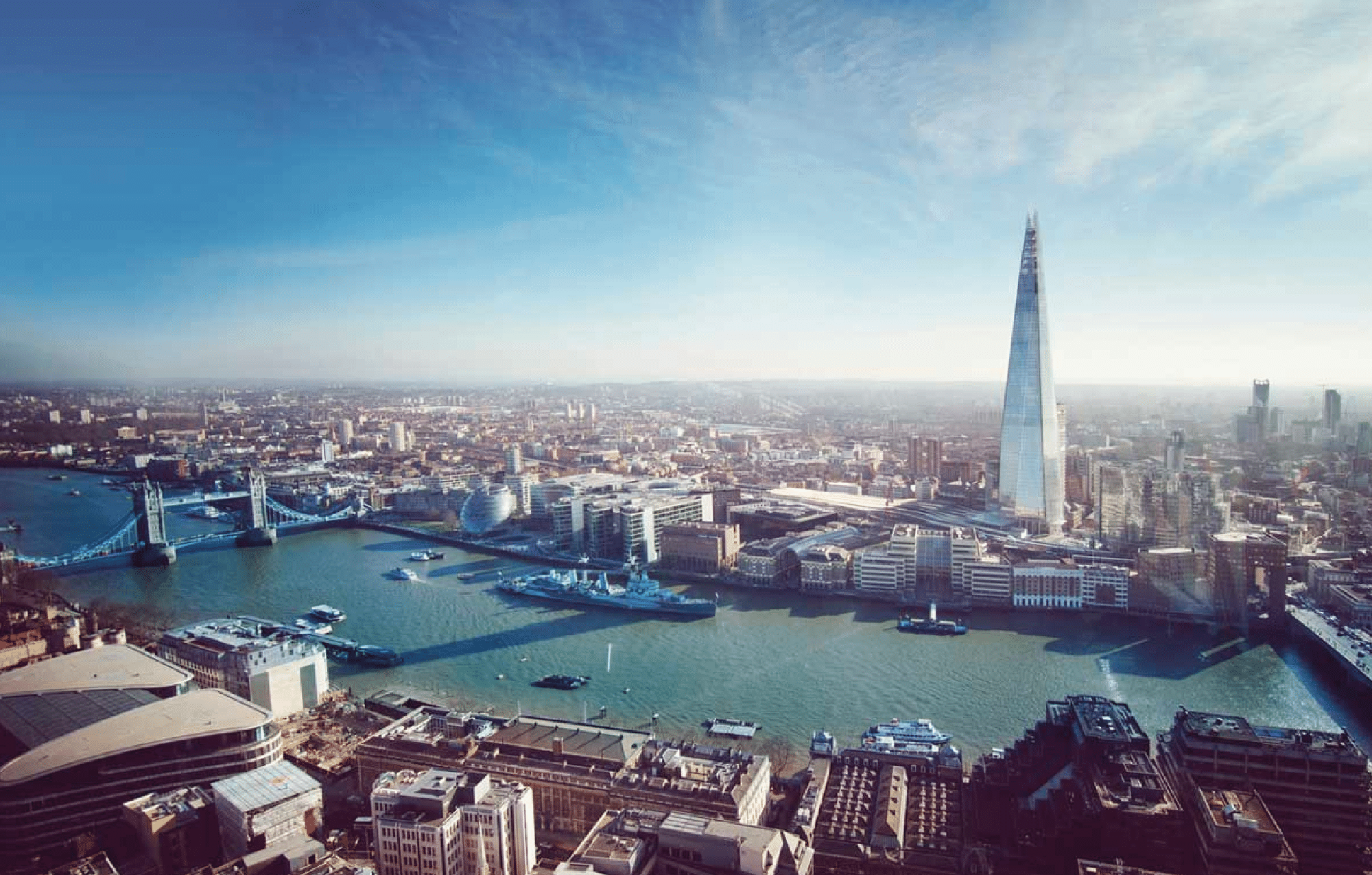

Helping Blend Network to be secure and compliant in a fast client onboarding process.

Key benefits

The business needed an ID verification platform that would be fast, accurate, scalable, flexible and cost-effective whilst complying with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

82%

Improved client conversion rate with the NorthRow solution

5

Second reduction time to process company information and risk score output

2,000

Lenders have registered on the Blend Network since 2019

Identity verification is crucial to Blend Network. It requires solid knowledge of the borrower and their repayment behaviour to ensure they are a real person and their contact information is valid. In addition, P2P lending often carries more significant risks of loan defaulting based on the non-creditworthiness of borrowers.

Blend Network wanted to ensure a flawless reputation through a real-time client onboarding process and maintain its position as a leading P2P lending provider whilst meeting compliance regulations for all its counter-party risks.

Brand reputation was a key factor for a fast-growing company like Blend Network when looking for an onboarding solution provider to deliver its due diligence.

Blend Network can now deliver faster client onboarding experiences with NorthRow’s single API with digital onboarding. The time taken to process company information and risk score output has been reduced to 5 seconds. With multiple identities, verification time reduced, on average, to one minute. Blend Network has improved its conversions to 82%, which is well beyond the industry average.

Blend Network now has the ability to verify multiple identity documents of borrowers and investors, including Passports, Driving Licences, National ID Cards, BRPs and Visas. Unlike other identity verification platforms, NorthRow has an intelligence-sharing agreement with law enforcement agencies, helping to reduce Blend Network’s business risk further.

The compliance team at Blend Network can quickly identify bad actors with comprehensive risk scores and Pass, Fail or Refer notifications. NorthRow’s experienced frontline support team ensures that all queries are answered quickly and efficiently. Blend Network is a high-growth P2P lender that needs responsive, efficient and accurate client support to continue its aspirational growth targets.

Zain Mirza

Head of Operations, Blend Network

Highly secure KYC/B and ID and verification cloud software.

With an extensive breadth of experience and leading software solutions, NorthRow helps businesses to successfully onboard new clients and employees. We do this through robust compliance, monitoring and remediation capabilities giving you peace of mind knowing the burden of risk management is taken care of. We unlock more time for you to focus on the single most important task – growing your business safely.

Book your free demo of our comprehensive ID&V, KYC, KYB and AML compliance management solution today.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive