Regulatory compliance for logistics

Break through regulatory barriers and master risk management

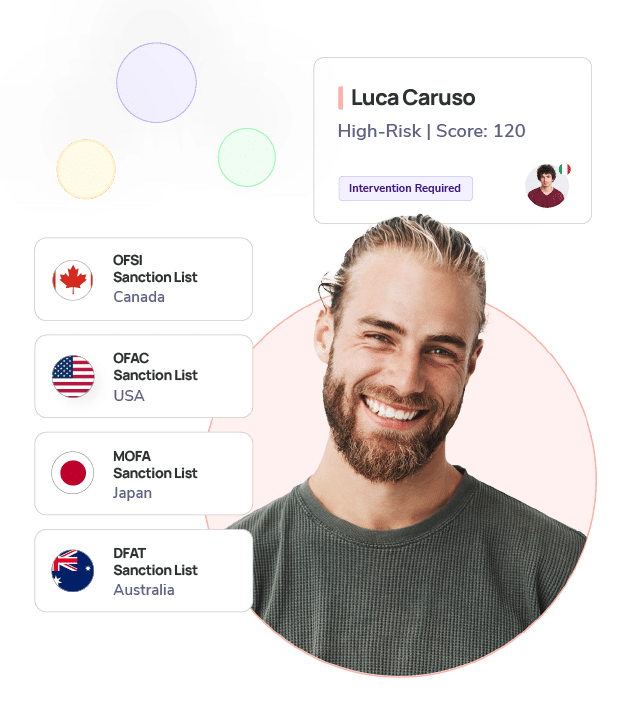

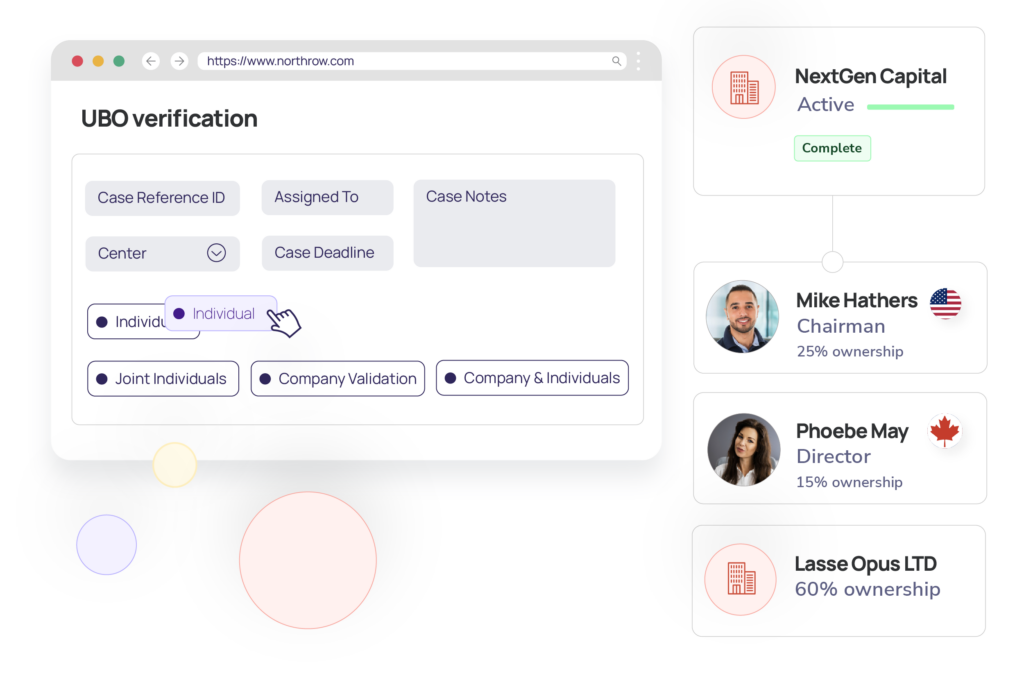

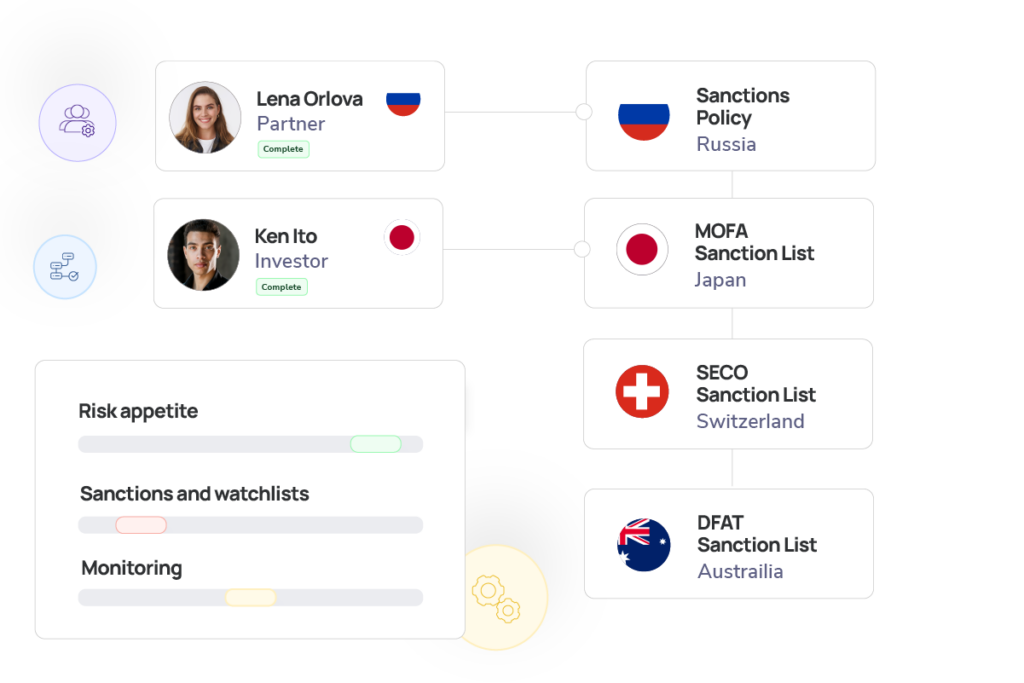

Automate the screening of clients, suppliers, and intermediaries to uncover hidden ownership structures, identify UBOs, and stay updated on sanctions and cross-border regulations for robust compliance.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive