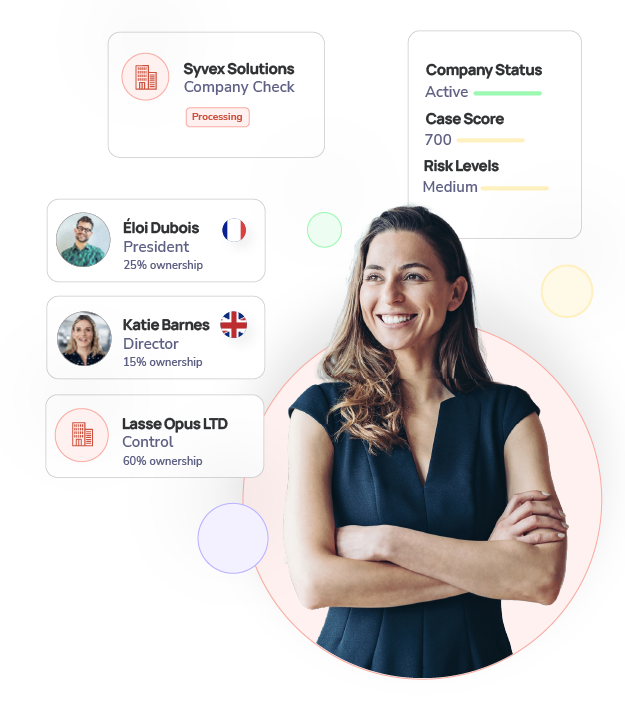

Know Your Business (KYB) software

Accurately verify business entities worldwide.

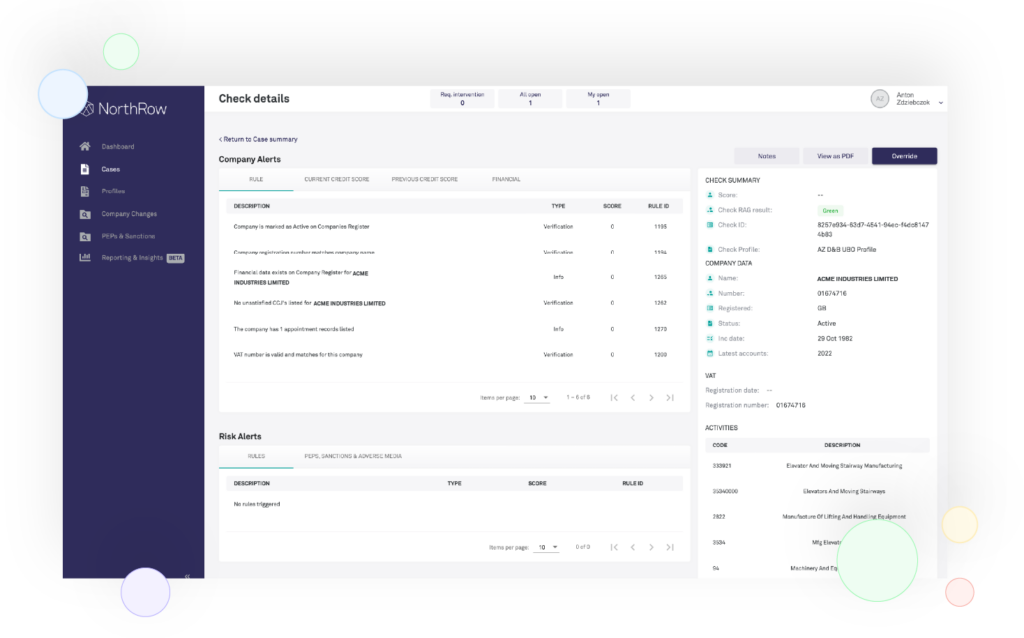

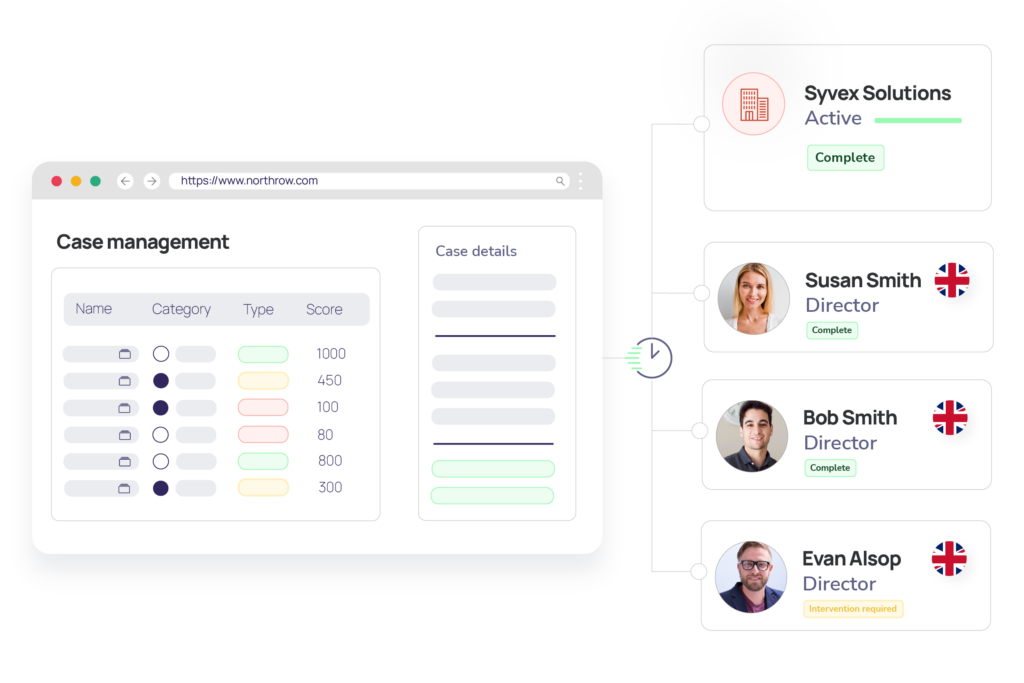

Streamline KYB compliance and reduce risk with automated ID verification, PEP, sanctions and watchlist screening, enhanced due diligence, and AML workflows, across one billion entities in 220+ jurisdictions.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive