Streamline and automate complex KYB onboarding

Simplify Know Your Business (KYB) compliance and diminish risk with automated ID verification, PEP, sanctions and watchlist screening, enhanced due diligence, and AML workflows.

Trusted by hundreds of companies to digitally transform their KYB compliance processes.

4.5/5

Get started today

Complete the form to request your demo

KYb Benefits

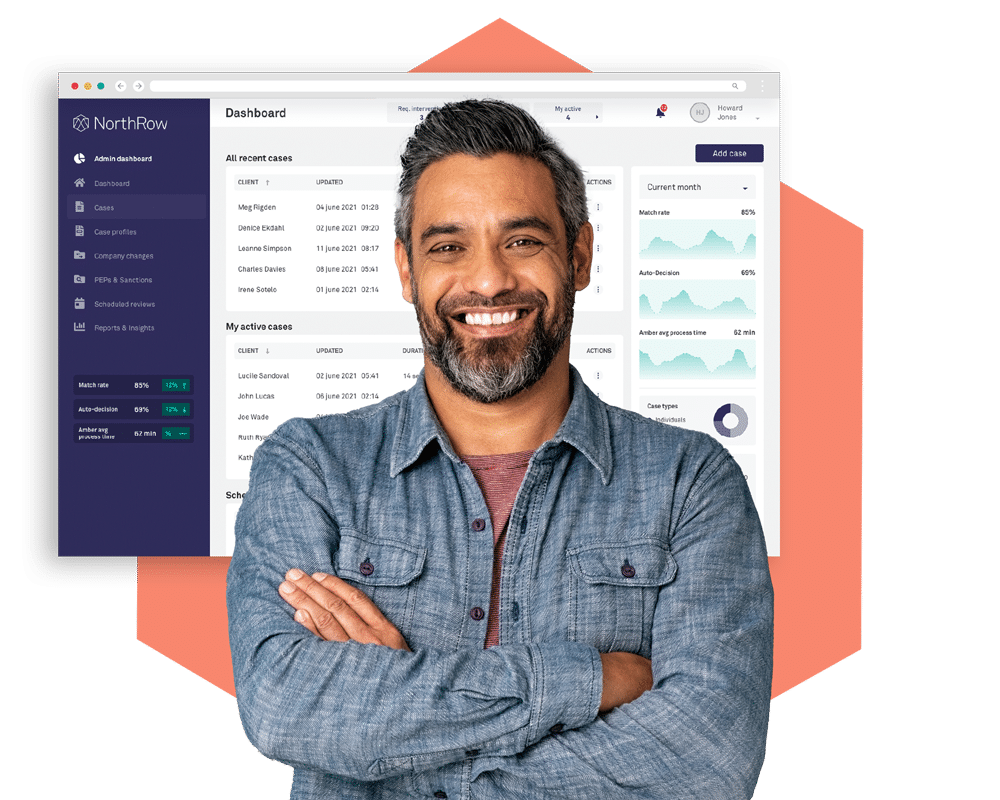

Alleviate manual KYB processes

Reduce the time to revenue by speeding up KYB checks while gaining a 98% match rate, helping you focus on growing your business, safely.

Make better risk-based decisions

Gain complete customer insight at the touch of a button, highlighting actionable data about the businesses you onboard and continue to monitor.

Reduce manual reviews

Onboard and monitor businesses at scale with real-time identification of high-risk businesses and custom alerts to stay on top of client changes.

Automated and global KYB service

Business screening and onboarding

Access unparalleled international data for identity KYB verification through a single API.

Ultimate Beneficial Ownership check

Simplify UBO verification by unravelling the complex ownership structures, enhancing risk appetite.

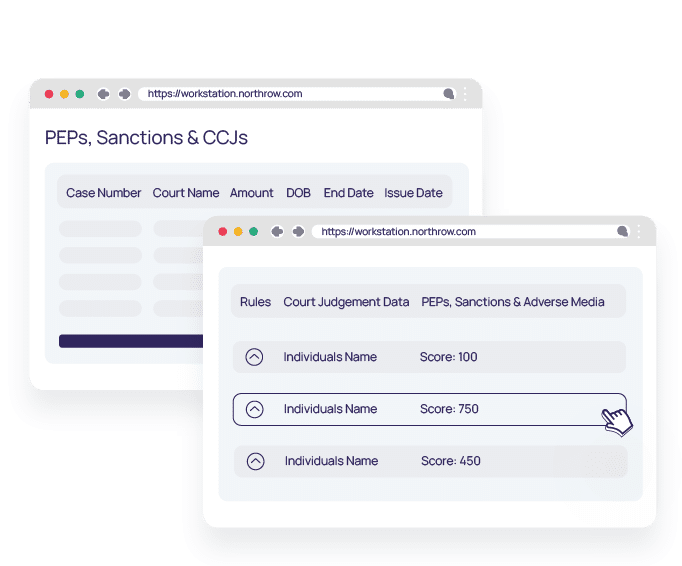

PEPs and Sanctions screening

Comply with 5MLD and screen against a comprehensive global sanction and PEPs list.

Identity, document and liveness verification

Automate verification and gain a 98% match rate and a 95% auto-decision rate.

AML regulatory compliance

Continue to remain compliant with our leading coverage of PEPs, sanctions and adverse media data.

Ongoing monitoring process

Tailor workflows to match your business risk profile and gain real-time alerts to flagged cases.

Onboard

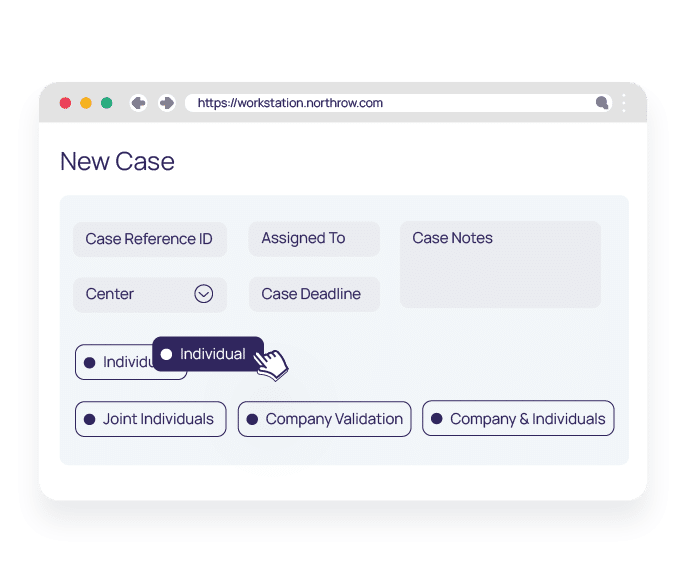

Automate business due diligence

Ensure the legitimacy of corporate clients, beneficial owners and associated companies with automated ID, fraud, PEPs, Sanctions, Adverse media, company and individual checks.

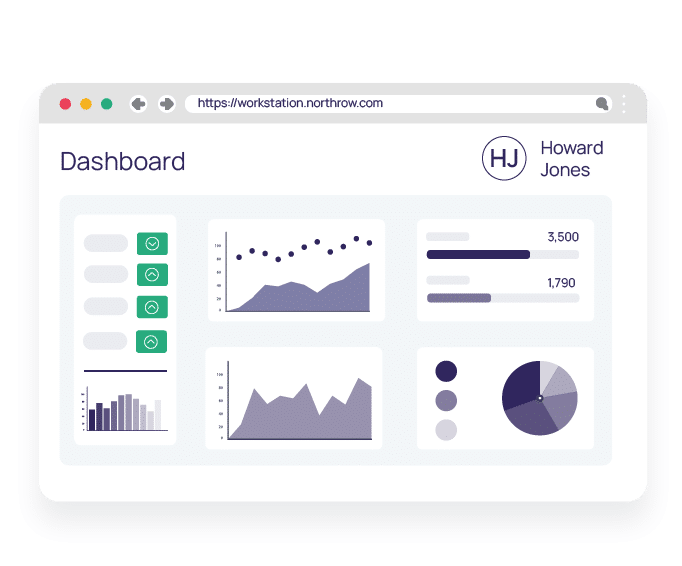

Improve

Continually enhance KYB processes

Automated data analysis identifies bottlenecks, auto-approved cases, average processing times and more, so you can continually improve your KYB compliance and risk management processes.

Manage

Gain a complete picture of customer activity

Continuously monitor businesses for any changes in their risk profile, including changes in ownership, adverse media and credit reference agency information.

How we help

Tailored KYB for your business

Validate businesses against public and commercial sources, checking stakeholder identities, as well as complex business structures and ultimate beneficial owners. With an automated compliance platform that is easy to configure and fully flexible, you can be certain your business’ risk appetite is always being adhered to.

KYC and KYB Screening

Conduct comprehensive AML screening on individuals and businesses.

Case management solution

Group checks into easy-access cases with a risk rating for each portfolio.

ID&V and Right to Work

Carry out comprehensive identity and document verification checks remotely.

AML compliance

Keep track of potential risks to ensure ongoing AML compliance.

Ongoing monitoring

Automated alerts notify you of any risk profile changes to both companies and individuals.

Remediation

Meet your KYC obligations and be confident that your customer data is up-to-date.

“

"As the world’s largest provider of flexible workspaces we needed to implement a robust customer onboarding solution that would be fast enough to meet customer demands but also secure enough to ensure that all compliance requirements were met or exceeded."

Michelle Valentine

Regus

Leading Data Providers

Global individual and company data coverage

Create complete risk profiles for individuals and businesses with data from unrivalled global sources covering over 200 jurisdictions.

1,000s

Users globally

250,000+

AML checks every year

98%

Match rate

95%

Auto-decision rate

We're a government certified IDSP

NorthRow is pleased to announce it has received certification under the Department for Culture, Media and Sport (DCMS) UK Digital Identity and Attributes Trust Framework. The business is now approved as an IDSP (Identity Service Provider) for right to work checks.

Got a question?

Frequently Asked Questions

For all of your burning questions, take a look at our FAQs below. Can’t find the answer to your question? Feel free to contact us directly and we’ll be happy to help.

At present, NorthRow has a number of key data providers that it is closely coupled too. These three suppliers are used in over 90% of checks undertaken within the system.

Lexis Nexis is our core provider of UK identity and address validation data, such as credit reference agency & electoral register data.

Acuris (often referred to as C6), is our core provider of Risk data, specifically PEPs, Sanctions & Adverse media data, which is one of the most important factors our platform checks, and is used in the majority of checks within the platform.

Creditsafe is our supplier for company data. Whenever a customer looks up a company within our system, the data about that business is provided by Creditsafe

At NorthRow we take security very seriously, we adhere to the highest, rigorous standards for data, privacy and security compliance. The data you send us is only used to verify your client’s identities and businesses. We never use it for any other purpose. We send it to third parties to complete the checks, and we can share our list of sub-processors with you so that you have full transparency of how your data is used.

Our products are tested continuously throughout our development process by a team of internal QA engineers. In addition to the application testing we regularly scan for vulnerabilities using third party services and undertake annual detailed penetration testing. We continually monitor new vulnerabilities and proactively work to ensure that we are protected.

We host our services within the EU on Amazon Web Services. The data is encrypted in transit and at rest using AES-256 keys. Almost all of our sub-processors are also hosted within the EU. However, we will advise you if you need a service that is not based in the EU.

NorthRow makes use of the Amazon Web Services and Microsoft Azure to ensure we do not have a single point of failure in our architecture. All the data we hold and the services we provide are backed up at regular intervals to protect against disruption or loss of data.

From the moment we work together, we hold your hand throughout the implementation process and continue through to ‘go live’.

Excellent customer service and continued support are all part of partnering with NorthRow. You can always email our support team at support@northrow.com if you have any queries.

All customers receive a dedicated account manager who will keep in touch to ensure you get the most out of our software.

Typically, we get our clients live within 14 days of them signing a contract.

What we do →

Understand how NorthRow can help you confidently onboard customers, manage risk and be compliant.

Why NorthRow →

How NorthRow ensures continued AML compliance in the most automated, efficient and accurate way possible.