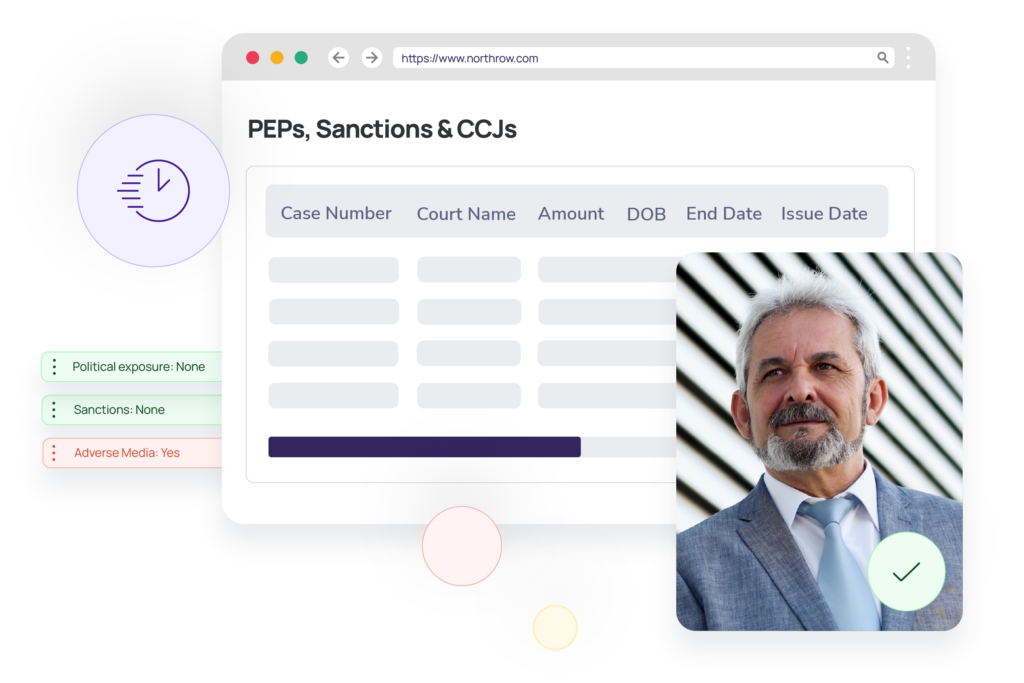

AML compliance for insurance

Future-proofing insurance against fraud and regulations

Cover all your AML compliance and fraud prevention needs with one platform. Perform AML checks, verify identities and businesses, uncover UBOs, and manage risks – all in one place.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive