AML compliance for forex firms

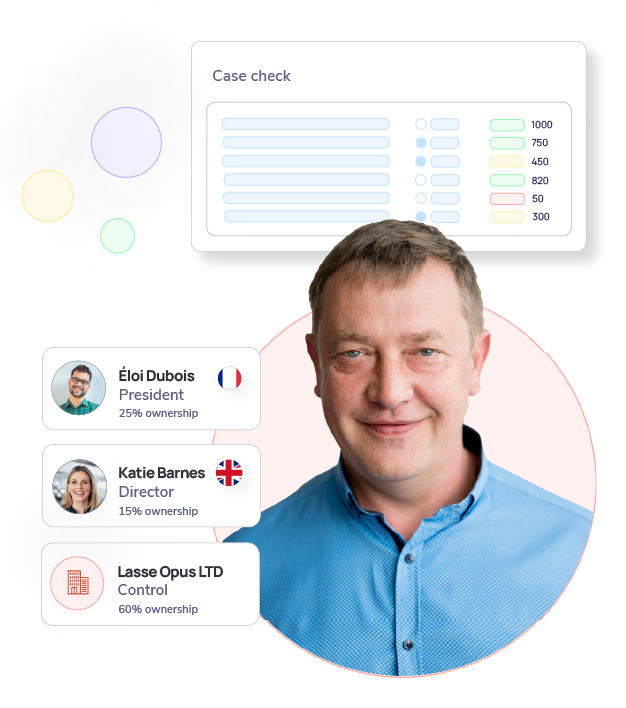

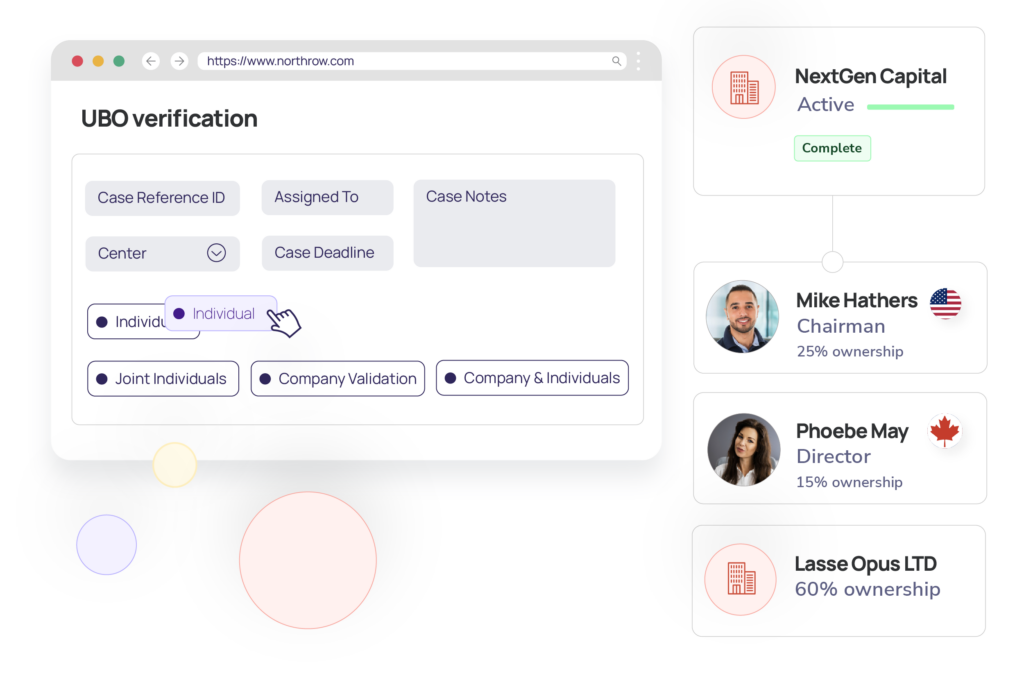

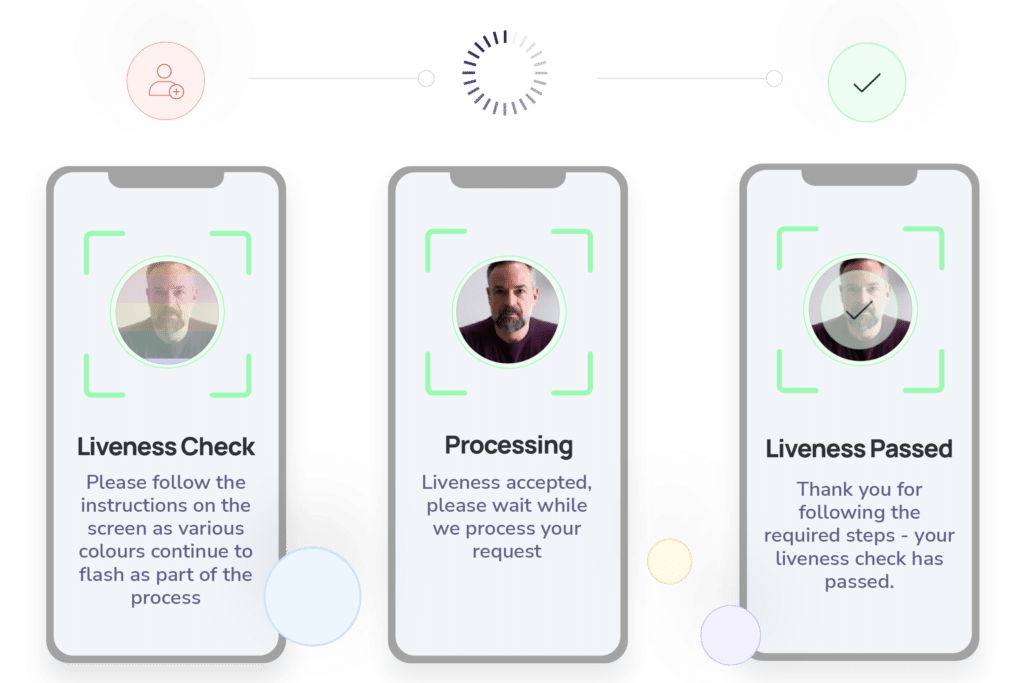

Ensure compliance and reduce risk with accurate KYC & KYB

Navigate the complexities of global trading regulations, verify client and business identities across borders, and protect against money laundering and fraud in the highly regulated and fast-moving currency exchange market.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive