KYC and fraud for e-commerce

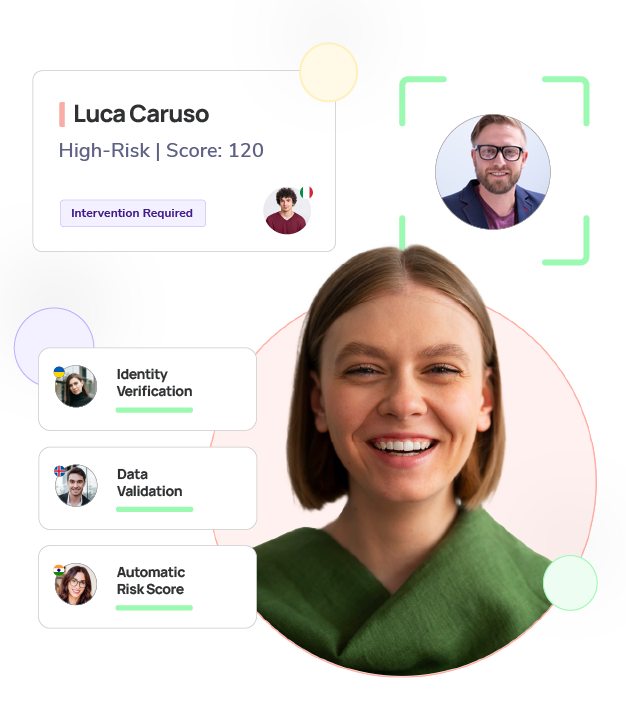

Boosting e-commerce with KYC and fraud prevention

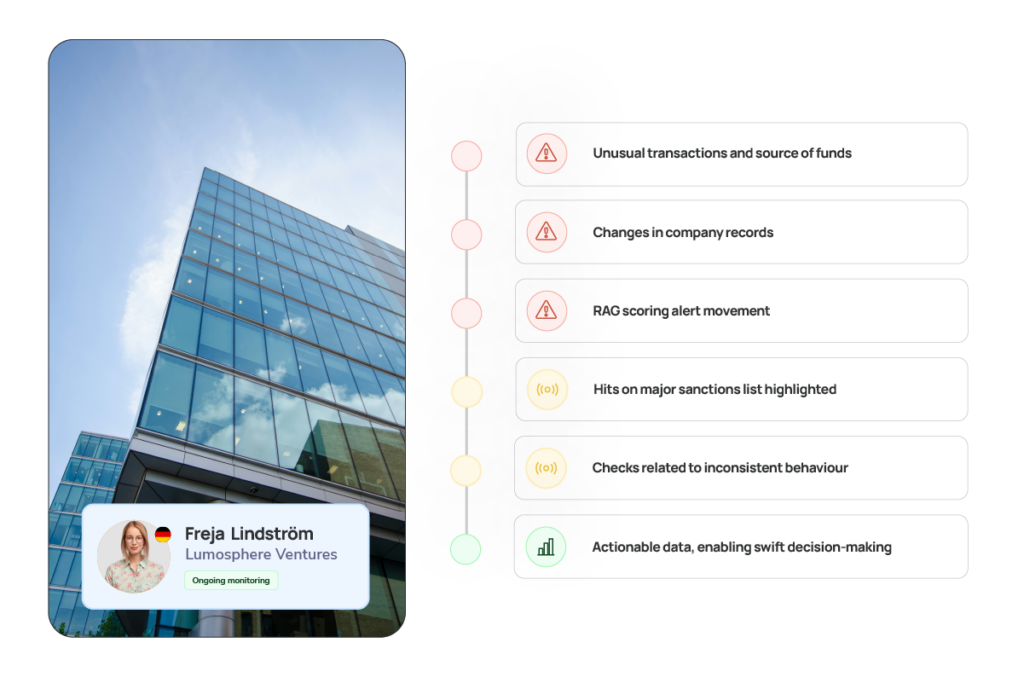

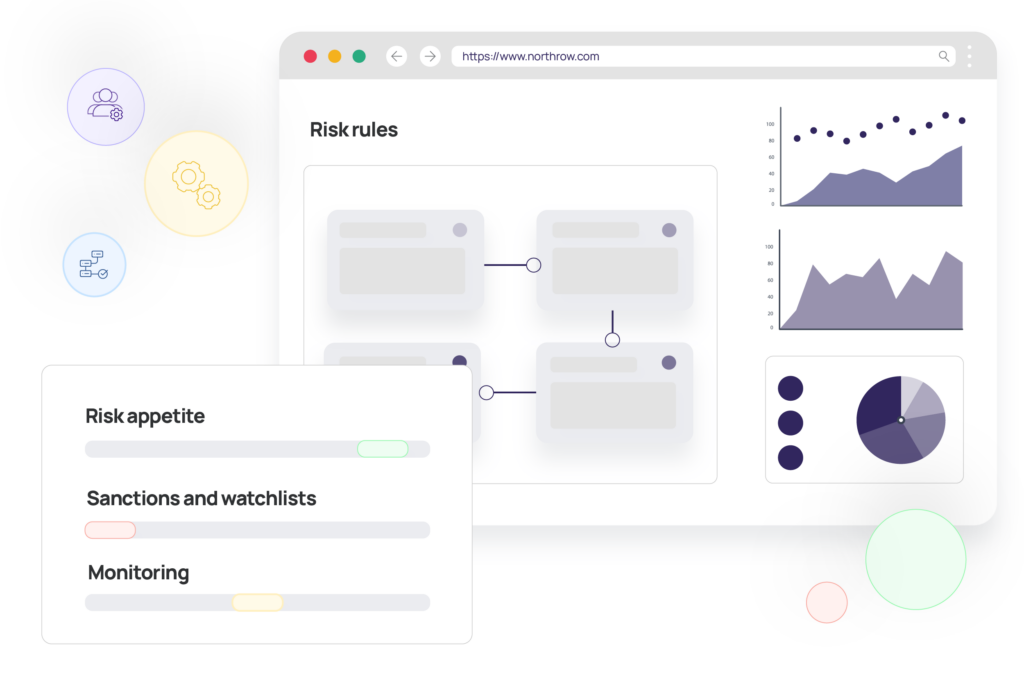

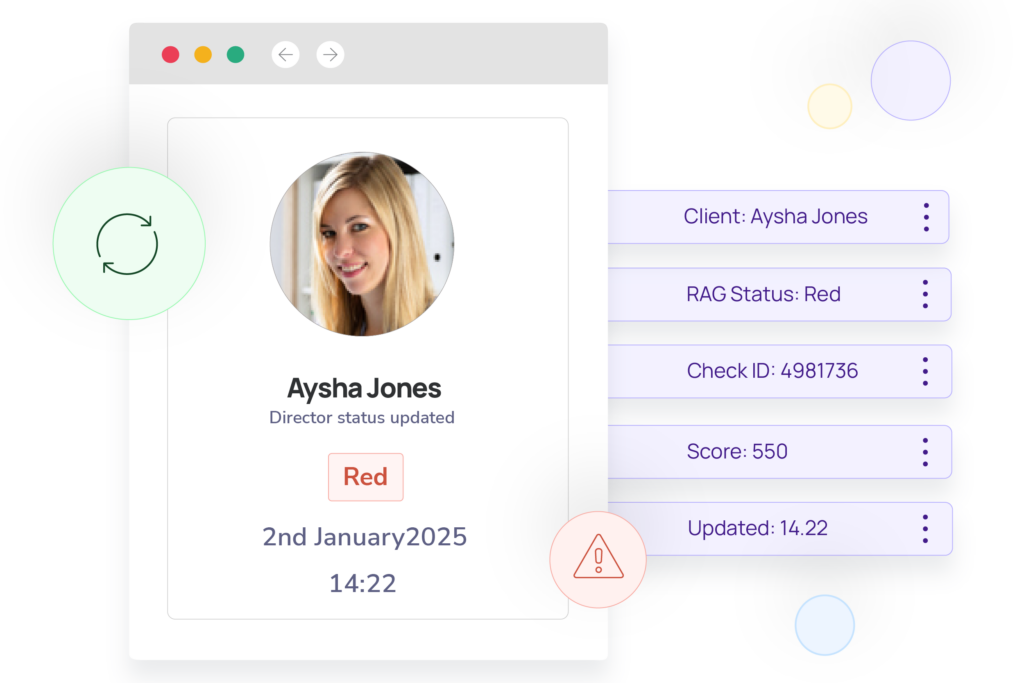

By automating compliance checks, integrating biometric technology, and mitigating potential risks proactively, NorthRow provides a scalable solution to support the growing demands of the e-commerce sector.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive