A guide to help you choose the right AML compliance software partner for your business, keeping you on the right side of both the law and efficiency.

Introduction

For professionals navigating the complex waters of Anti-Money Laundering (AML), staying abreast of changing regulatory requirements, ensuring compliance, and supporting business processes and growth can be a mammoth task.

While challenging, there are tools that can not only simplify, but enhance the entire process of compliance. That’s where software can come into play, not to replace talented compliance teams and their expertise, but to improve processes, ease manual workloads, delight customers, and become a trusted partner in the fight against financial crime.

Table of contents

What is AML software?

AML software solutions are digital platforms designed to assist businesses in conducting identity verification, risk assessment, ongoing customer due diligence, and monitoring.

These technologies aim to streamline and automate the process of vetting businesses and individuals, verifying identities, and ensuring clients are not involved in money laundering or other illicit activities.

With countless solutions on the market, each offering their own approach of improving your compliance processes, we’ve put together this guide to help you make your own mind up.

AML solutions and systems help institutions comply with regulations designed to prevent financial crimes on the local and global scale.

the-cfo.io

The UK's Financial RegulatIONS

Understanding AML compliance requirements in the UK

Before we dive into the world of AML compliance software tools, let’s go back to basics.

At the heart of every regulated firm’s AML commitments in the UK is the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 – or MLR 2017. In effect, the MLR is the ‘rulebook’ for compliance that regulates the safety of financial transactions. It sets out the obligations of firms working in industries where money laundering, terrorist financing, and other forms of financial crime are a significant risk. In its simplest form, MLR 2017 aims to stop bad actors from using firms to launder illicit funds by requiring firms to put measures in place to identify their clients, monitor how they use their services, and adopt a risk-based approach to commercial relationships.

Day-to-day, the FCA and other regulatory bodies play the pivotal role of watchful guardian, ensuring firms comply with MLR 2017 and any industry specific requirements, sharing guidance, advice, and conducting regular audits or interventions where needed.

Every firm operating in the industries cited by MLR 2017 must be registered and authorised by the FCA or another regulatory body in order to operate in the UK. These industries include credit and financial institutions, auditors, independent legal practitioners, estate agents, casinos, and high value dealers, among others.

Failing to comply with MLR 2017 and any sector-specific legislation that may apply can have far-reaching and devastating consequences. From fines and reputational damage to criminal proceedings and even imprisonment; any instance of non-compliance can severely impact business operations and public perception.

Understanding whether you need compliance software

Who needs AML compliance software?

If your business falls within any of the industries listed under the UK’s categories within MLR 2017, thus requiring AML checks to be undertaken, then AML compliance software is likely already on your radar. These industries are:

Trust or company service providers

Financial service institutions

Auditors, external accountants, and tax advisers

Independent legal professionals

Estate agents

Credit institutions

High value dealers

Casinos

Regulated organisations have three key duties when it comes to preventing money laundering and ensuring compliance with regulation. This starts with identifying their customers, then verifying they are, in fact, who they say they are and finally, monitoring their activity throughout their entire lifecycle as a customer to ensure nothing changes for the duration of the relationship between them and the financial organisation.

As time goes on, risk profiles can change dramatically from the beginning of a commercial relationship, increasing risk and the threat of financial crime. Ongoing monitoring is a critical step in AML compliance, tracking customers for any changes to an individual’s or organisation’s risk profile such as global sanctions, negative media, new directorships or political exposure.

Technology has fast become a key part of the compliance professional’s toolkit when performing customer due diligence. The sheer volume of clients many organisations will be onboarding and servicing on a daily basis makes technology a logical investment to help with the achievement of AML compliance by identifying and preventing money laundering and other forms of financial crime.

And, for those who are spending hours manually sifting through data and documents to ensure compliance, an automated, digital solution can be a game-changer.

YOUR IDEAL AML COMPLIANCE PARTNER

Features to look out for

When it comes to compliance software, your firm’s specific requirements may vary greatly from those of your competitors, peers, and others in the industry. Importantly, it is crucial to detail those requirements early on in your selection process. Put together a list of non-negotiable ‘must-have’ and ‘nice-to-have’ features that fit your current onboarding processes and AML compliance strategies.

This is an ideal time to re-evaluate your existing workflows and assess their efficacy. Do your current processes seem overly complex? Is there any unnecessary red tape that hampers productivity? Digitising inefficient procedures is futile; so, use this opportunity to reinvent your current strategies and processes.

Below, you’ll find an overview of just some of the key features to look out for in any good AML compliance solution.

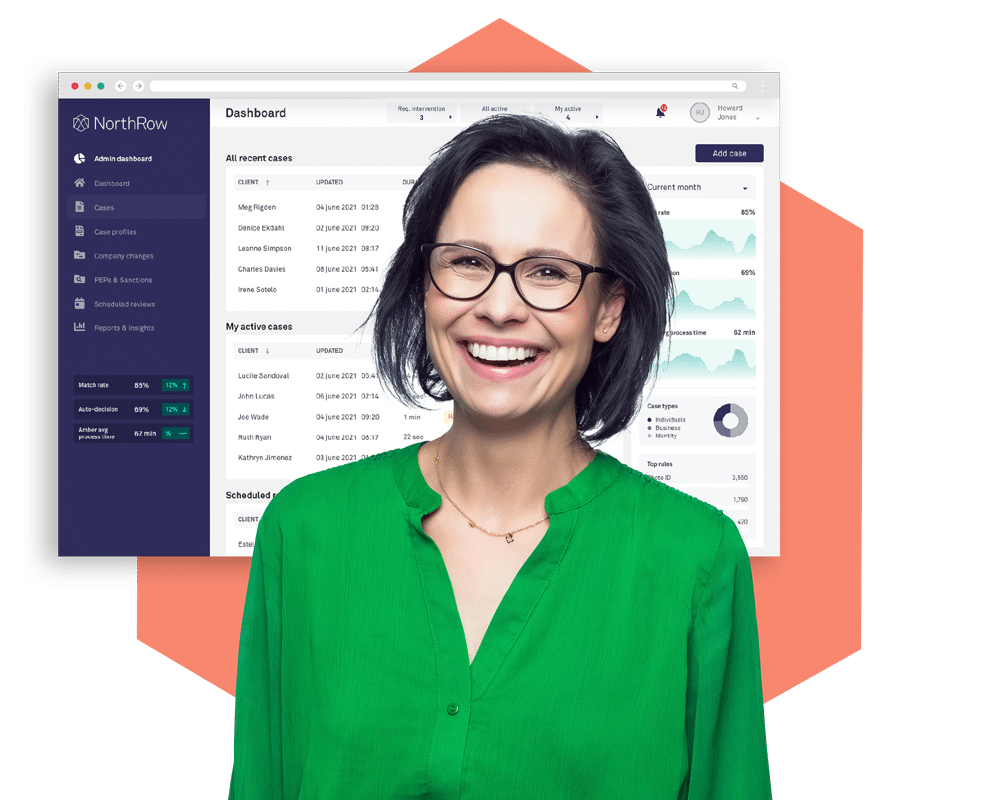

Simple individual verification (KYC)

Make sure your solution of choice is able to carry out robust KYC checks, ensuring the automated verification of individuals while screening them against global watchlists for any political exposure or sanctions.

Streamlined business onboarding (KYB)

Ensure software can help you to ensure the veracity of businesses, simplify complex corporate structures, research any adverse media, and identify major shareholders, ultimate beneficial owners and directors.

CDD and EDD automation

The software should be able to automatically differentiate between instances where standard Customer Due Diligence (CDD) or more rigorous Enhanced Due Diligence (EDD) is required.

Simple risk assessment

A good solution won’t just gather data but will give you actionable insight based on your risk appetite, helping to flag and understand any potential risks.

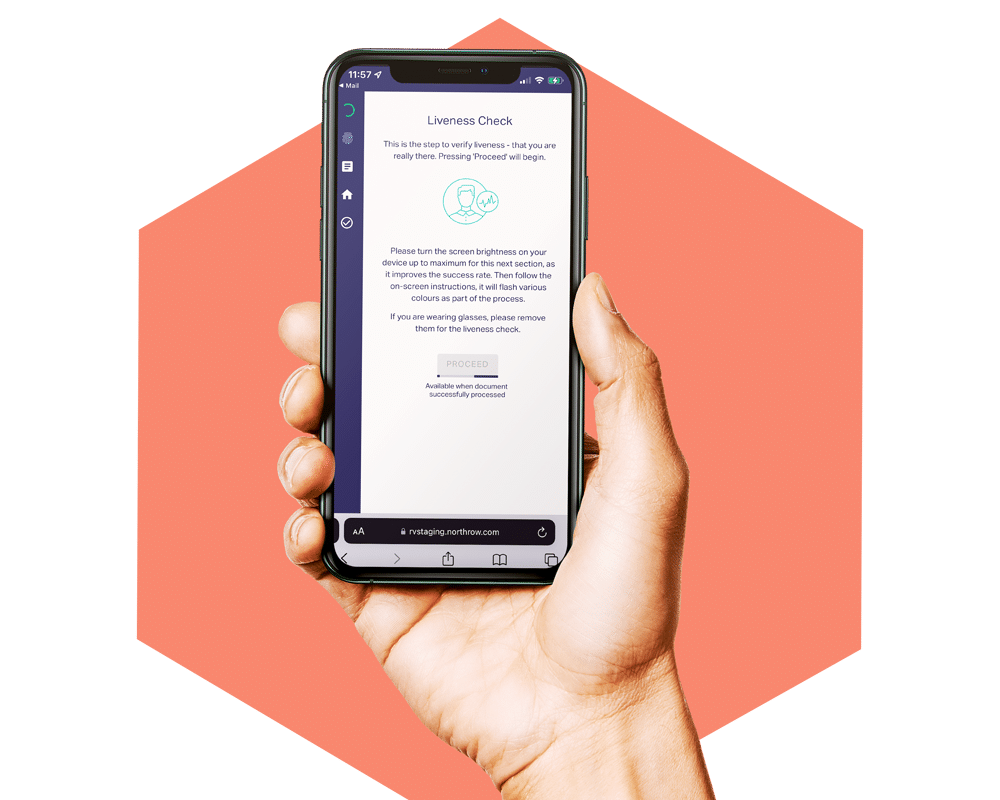

Effortless ID and verification (ID&V)

ID&V is the bedrock of robust AML compliance. As part of your suite of AML compliance software, an integrated ID&V tool will help to confirm that individuals are who they claim to be, streamlining identity checks for faster, more accurate vetting processes.

Comprehensive PEP and sanction screening

A crucial step in AML compliance, the software should be able to screen clients against global sanction lists and Politically Exposed Person (PEP) registers, ensuring you’re not inadvertently partnering with someone you shouldn’t.

Adverse media monitoring

Keeping on top of adverse media coverage of your clients is key to understanding the level of risk they pose or will pose in the future. Your software of choice should be able to automate and aggregate any negative hits in the press.

Case management

Since most firms have numerous checks and ongoing monitoring instances to manage, ensure your software can manage these cases effectively and store records with ease.

Easy-access record-keeping

The FCA and other regulators have specific requirements surrounding reporting and auditing, so having a tool that can create and format reports quickly and efficiently is invaluable.

Integration with other systems

Integrating your AML software with your existing systems is paramount to ensuring your compliance operation runs smoothly and efficiently.

Security and data protection

Safeguarding your data and privacy

At a time when data breaches and cyberattacks are regularly making headlines, choosing a software partner isn’t just about features; it’s about choosing a solution that strengthens and enhances your digital defences.

Implementing AML compliance software should not come at the expense of security and data protection, it should improve the robust protocols your firm already has in place to protect sensitive customer data, personal documents, and financial information. Prioritise platforms with top-notch security measures, recognised data protection certifications, and regular vulnerability assessments.

As part of most client onboarding processes, firms collect all kinds of sensitive customer data such as addresses, contact details, bank account information, and copies of identity documents. In order to comply with GDPR requirements, ensure that the data being gathered by your compliance software partner is also being collected, stored, and processed in a manner that respects individual rights under the GDPR and maintains trust.

Look out for software providers that are ISO 27001 certified, too. Being ISO 27001 certified means that a business takes information security seriously and commits to safeguarding the data of its customers, partners, and stakeholders. These businesses are independently audited and held to stringent information management standards.

When you work with an ISO27001 certified supplier, you can expect them to have a robust cyber security programme in place that protects your data and helps you meet compliance requirements. They will be committed to ensuring the security of their systems and networks, minimising the risk of data breaches or cyber security incidents.

My Digital

Scalability and customisation

Software that grows with you

AML requirements are rarely static, so your software partner shouldn’t be either.

Choosing a vendor that evolves with regulation, your internal compliance processes, and growth trajectory will allow your business to expand without constraints.

As regulations evolve, so too must your compliance software. An adaptable AML software solution ensures that when these regulations shift, the system is updated to reflect these changes, safeguarding your business from potential non-compliance.

Importantly, compliance software should be fully customisable to your business’ unique risk appetite. Every business has its own definition of ‘high’ or ‘low’ risk in terms of due diligence. Make sure you are able to customise your risk profile within the system depending on what you perceive to be high or low risk. Customisable risk parameters mean your software aligns with your company’s strategic objectives and risk tolerance, allowing for a more precise and tailored approach to potential red flags.

What’s more, it’s key that compliance partners can scale with your business as it grows. Taking on new clients or entering new markets means that the volume of associated AML checks will grow. Scalable AML software ensures that this growth doesn’t lead to operational bottlenecks. Together with the software, your firm should be able to handle an increased number of checks, reports, and alerts seamlessly without compromising on speed or accuracy.

At its core, AML compliance software is the bridge between prospective customers and paying ones; helping your compliance team to make the call on whether to onboard new clients or not. As such, choose a software partner that can not only make the onboarding process as smooth as possible for your clients, but can also handle increased volumes of AML checks as your business grows.

INTEGRATIONS WITH YOUR EXISTING TECH STACK

A solution that complements your AML processes

Achieving efficiency, accuracy, and speed as part of AML compliance is paramount. As industries become more technologically intertwined, the importance of seamless integrations with AML compliance software becomes magnified.

Most modern businesses operate using a myriad of software solutions, each designed to address specific needs or business processes. This is where the power of integrations, particularly through API access, really comes to the forefront.

Integrating existing systems with your AML compliance solution can provide a 360° view to key departments and stakeholders. This will allow information to flow between departments and functions, and into or from your AML compliance platform.

Remember that while the core features of AML compliance software are undeniably crucial, its integration capabilities are what can truly boost its potential. In today’s business world, a siloed approach is not only inefficient but risky.

Embracing integrations is a stride towards cohesive, efficient, and more robust compliance management.

AML software integration in practice 🔀

A bank may use a CRM system to manage new client onboarding. When an account manager enters the details of a new client, your integrated AML software immediately runs a check using the provided details. Similarly, any changes in customer status or details within the CRM can be mirrored in your AML software, ensuring that checks or reports are always based on up-to-date information.

COST CONSIDERATIONS

Ensuring the best return on investment

Choosing the right AML software isn’t just about features and compatibility – it’s about cost and the return on investment you can expect to see.

With any purchase, it can be easy to be swayed by the up-front price tag without looking deeper into additional costs such as maintenance fees, updates and upgrades, and any add-ons.

As you evaluate your options, look beyond the initial price tag and also consider efficiency gains, improved accuracy, and simpler processes. Only then can you make an informed decision, ensuring that your chosen software is not just a tool but becomes a valuable asset for your organisation.

Simpler AML compliance

Consider the time saved by automating manual processes and the potential reduction in operational errors. Efficient software can significantly reduce the manpower hours needed, leading to substantial savings in time and headcount.

Reduced risk of non-compliance

Cases of non-compliance can lead to hefty fines and reputational damage. When assessing the ROI of AML compliance software, factor in the potential costs of non-compliance that it will help to reduce.

Maintenance and updates

Some vendors might provide free maintenance and updates for an initial period, but there could be fees thereafter. You might also find that you need additional features not included in your original package. These can come at an extra cost.

Customer Due Diligence processes can benefit hugely from investment in technology and software, with automated ‘know your customer’ and identity authentication processes not only strengthening fraud and financial crime checks, but also improving overall customer experiences.

The Banker

VENDOR REPUTATION

Choosing the best software partner

When you’re in the latter stages of your research into compliance software vendors, the features on offer, and your own internal use cases, processes, and strategies, now is the time to ensure that you partner with the ‘best fit’ for your business. As critical as the software itself is the vendor behind it.

Ensuring a successful partnership 🤩

Consider the business’ reputation and experience with others in your industry. Vendors with extensive industry experience often have a proven track record of addressing the complex challenges businesses like yours face in AML compliance. A vendor’s history in the sector can provide insights into their depth of expertise.

Real-world user feedback 🗣️

While every vendor will tout the superiority of their solution, real-world examples provide the most tangible evidence of the software’s effectiveness. Case studies offer a detailed look into how the AML software has been used in practical scenarios. They showcase challenges faced by clients, how the software addressed those challenges, and the results achieved.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution today.