Tracking down the Ultimate Beneficial Owner (UBO) of a company can sometimes feel like chasing shadows. For regulated firms like yours, this task is essential for protecting your business from risks tied to financial crime.

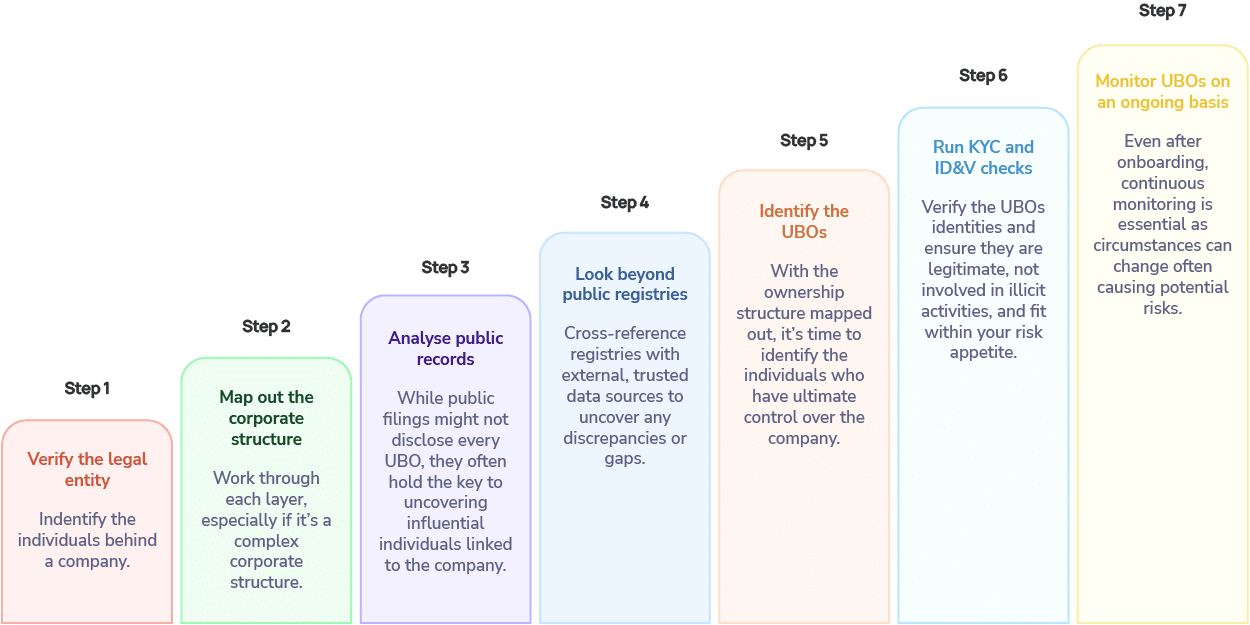

Check out our handy 7-step blueprint to UBO transparency that is helping firms like yours cut through the noise and uncover the truth behind undisclosed owners. What’s more, each step is built into how our AML platform works!

Step 1: Verify the legal entity

Before identifying the individuals behind a company, it’s essential to confirm the legitimacy of the organisation itself. This step involves gathering core details about the company’s structure and official records.

How does NorthRow help? Access reliable data from official registries and government sources to verify an entity’s legitimacy in a few clicks. Our platform streamlines this process, enabling you to confirm registration numbers, business type, registered address, and more with ease.

Step 2: Map out the corporate structure

Start by mapping out all entities and individuals involved, working through each layer, especially if it’s a complex corporate structure. Identify the main company and its subsidiaries, but don’t stop there. Examine holding companies, trusts, and joint ventures that could obscure the real UBOs.

Top tip: Map out the company’s ownership chain step by step, from the top to the bottom. If shares are held by another company, continue researching down that chain until you find the natural persons with control.

How can NorthRow help? Our platform automatically identifies linked companies, subsidiaries, trusts, and holding companies, making it easier to trace ownership and uncover the true UBOs behind the corporate layers.

Step 3: Analyse public records

Many companies often file financial statements, tax records, of annual reports in multiple jurisdictions, sometimes revealing beneficial owners. While public filings might not disclose every UBO, they often hold the key to uncovering influential individuals linked to the company through directorships or shareholder roles, revealing the true power behind the scenes.

DO: Make sure to cross-reference directors with shareholder lists for discrepancies.

DO NOT: Assume that all financial records or public filings are accurate at face value. Companies may have reasons for omitting or obscuring certain details that require a deeper investigation.

How can NorthRow help? With easy access to global financial documents, records, and filings, our platform helps you identify indirect ownership and influence, uncovering UBOs who may be hidden within complex structures.

Step 4: Look beyond public registries

Registries are a starting point, not the full picture. Cross-reference them with external, trusted data sources to uncover any discrepancies or gaps.

How can NorthRow help? Integrations with 20+ global databases like Dun & Bradstreet, Acuris, and Creditsafe allow you to cross-reference ownership and corporate structures across multiple jurisdictions by combining registry data with these trusted sources.

Step 5: Identify the UBOs

With the ownership structure mapped out, it’s time to identify the individuals who have ultimate control over the company. UBOs may not always appear directly in the ownership records, so this is where careful scrutiny comes into play.

DO: Identify who has a significant ownership stake or influence over the company. This is typically anyone with a 25% or more ownership, but it can vary by jurisdiction.

DO NOT: Rely on ownership percentage alone. Pay attention to indirect control through voting rights or shareholder agreements, which could indicate influence that’s not reflected in ownership stakes.

How can NorthRow help? Our platform cross-references multiple data sources and identifies control structures, helping you pinpoint UBOs even if they aren’t directly listed in the ownership records.

Step 6: Run KYC and ID&V checks

Now that you’ve gathered key details, it’s time to run KYC (Know Your Customer) and ID&V (Identity Verification) checks on the individuals identified as beneficiaries. This process verifies their identity and ensures they are legitimate, not involved in illicit activities, and fit within your risk appetite.

Top tip: For high-risk UBOs, implement Enhanced Due Diligence (EDD) to look deeper into their background and ongoing activities.

How can NorthRow help? NorthRow streamlines the KYC and ID&V process, providing instant verification of more than 13,000 ID documents, such as passports and driving licenses, and screening against global sanctions and PEP lists.

Step 7: Monitor UBOs on an ongoing basis

UBO verification isn’t a one-and-done process.

Even after onboarding, continuous monitoring is essential. Circumstances change – an individual may be added to a sanctions list, become a PEP, or appear in adverse news at any time. Regular updates to your records keep you ahead of potential risks.

Top tip: Implement automated monitoring tools to track any changes in UBO status, including alerts for sanctions lists, PEPs, or adverse media. This ensures that you’re notified in real-time if anything significant occurs.

How can NorthRow help? With round-the-clock ongoing monitoring, our system tracks UBOs for any changes to their risk profile. You’ll get real-time alerts if a UBO is added to a sanctions list, becomes a PEP, or is linked to any adverse media, ensuring you’re always up to date and ahead of potential threats.