Identifying the true owners behind a company is one of the key challenges in Anti-Money Laundering (AML) compliance. As businesses grow more complex, tracing who actually controls them can be difficult. Behind the scenes, some entities work hard to mask the real individuals benefiting from their profits, using various tactics to stay out of view. This is where red flags come into play.

These red flags point to patterns that could indicate someone is trying to hide their ownership of a business, often for illegal reasons like money laundering or fraud. While seeing one or two of these signs doesn’t automatically mean something’s wrong, they should serve as a signal to take a closer look.

🔗 3 ways complex corporate structures are used to obscure true ownership

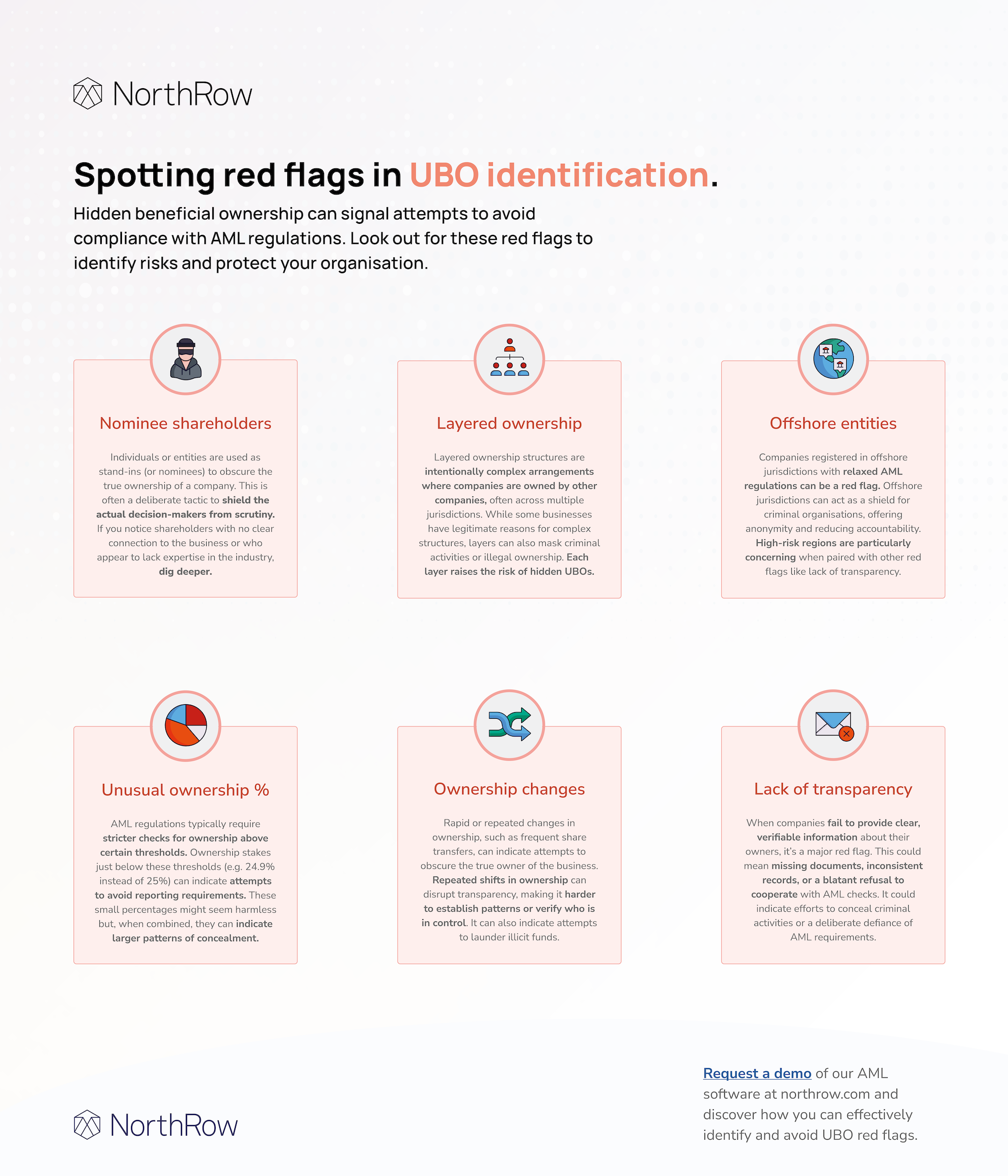

This infographic highlights six key red flags that could point to hidden UBOs. They represent common techniques used to make ownership appear more complicated than it really is, often to cover up illicit activities. Recognising these signs will help you feel more confident in your approach to UBO identification and AML compliance.