In the world of finance, combatting crime and ensuring compliance are crucial, and politically exposed persons (PEPs) play a pivotal role in this arena. Given the influential positions they hold and their access to substantial funding, PEPs are susceptible to bribery, corruption, and other financial misconduct.

This may make you hesitant to work with these individuals; however, it’s important to note that PEP status doesn’t necessarily mean you should avoid working with these individuals. PEP screenings are a crucial tool for checking the status of these individuals, and these checks can help you with your decision-making process.

In this blog, we provide an in-depth explanation of the PEP screening process, break down the different risk tiers associated with PEPs, and introduce compliance software that can assist you in effectively screening PEPs.

What is a PEP?

A Politically Exposed Person (PEP) is an individual who is or has had a prominent public function, either elected or appointed, with substantial authority over policy, operations or the use or allocation of government-owned resources. These individuals may have been entrusted with a high position by a community institution, an international body or a state within the last 12 months.

A PEP is generally considered to be more susceptible to being involved in bribery and corruption due to their public position or function. The nature of their position means they typically have more opportunity to acquire assets and funds through unlawful means such as bribery and corruption. In turn, this increases the potential to launder these ill-gotten funds.

A PEP is not just high risk when they are active within their position. They may still pose some risk once they have left office by remaining a target. Due to this, continued enhanced due diligence is often wise to ensure the risk of these high-risk customers is managed.

It is important to note that PEPs also include the person’s close family members, business associates, and other beneficial owners of the person’s property.

Examples of PEPs

Example of PEPs includes heads of state, members of legislative bodies, government ministers, judges, high-ranking members of the armed forces and senior officials of state-owned enterprises. The Fourth Directive extended the definition of PEPs to include domestic citizens as well as foreign ones.

Importance of PEP screening

PEPs are higher-risk clients for institutions and financial firms to onboard because they are exposed to more opportunities to accept bribes, be involved in corruption by virtue of their position and launder money.

PEPs, as well as their families and persons known to be close associates, are required to be subject to enhanced scrutiny by regulated firms. Family members include spouses, parents, siblings, children, and the spouse’s parents or siblings. Close associates, on the other hand, are individuals known to have joint beneficial ownership of a legal entity or any other close business relationship. Individuals who have sole beneficial ownership of a legal entity which was set up for the benefit of the PEP also fall into this category.

If a client does have a PEP status, this does not automatically signify guilt or suggest a link to money laundering activities; it simply means that appropriate due diligence and ongoing monitoring need to be conducted, and the organisations risk appetite should be considered.

Who should screen for PEPs?

Financial institutions, such as banks and credit unions, must screen for PEPs in order to remain AML compliant. This should ideally take place during the KYC onboarding process so that a risk status can be assigned to them before a business relationship is entered into.

Important elements for effective PEP screening

When it comes to PEP screening, there are several ways you can go about it; however, there are some key elements that can help make the process more effective. This includes:

- Identifying and verifying PEPs: During onboarding, it is essential to determine whether a new customer is a PEP or not

- Customer due diligence: This can involve various steps, such as checking to see whether the PEP has ever been involved in financial crimes

- PEP risk assessment: The results of the due diligence process will also be used here to assess the level of risk associated with the PEP

- Approval: Senior management must approve the PEP customer before a formal agreement is entered into

- Ongoing customer monitoring: Regular screening is essential to monitor a PEP status and mitigate risk

How do you differentiate between a high- and low-risk PEP?

Due to the broad scope of who is considered a PEP, determining between high-risk and low-risk PEPs can be difficult, particularly when you are processing transactions or checks en masse.

The general PEP definition is primarily based on the Financial Action Task Force (FATF) Guidance on Politically Exposed Persons, but there are official definitions found in the 4th and 5th MLD, amongst others.

While such definitions are valid sources to define a mandated approach to compliance, NorthRow believes they are not sufficiently detailed for its clients to verify between a high or low-risk PEP efficiently. The definitions treat all PEPs equally from a risk approach and don’t go into the granular detail needed to easily differentiate between low and high-risk PEPs.

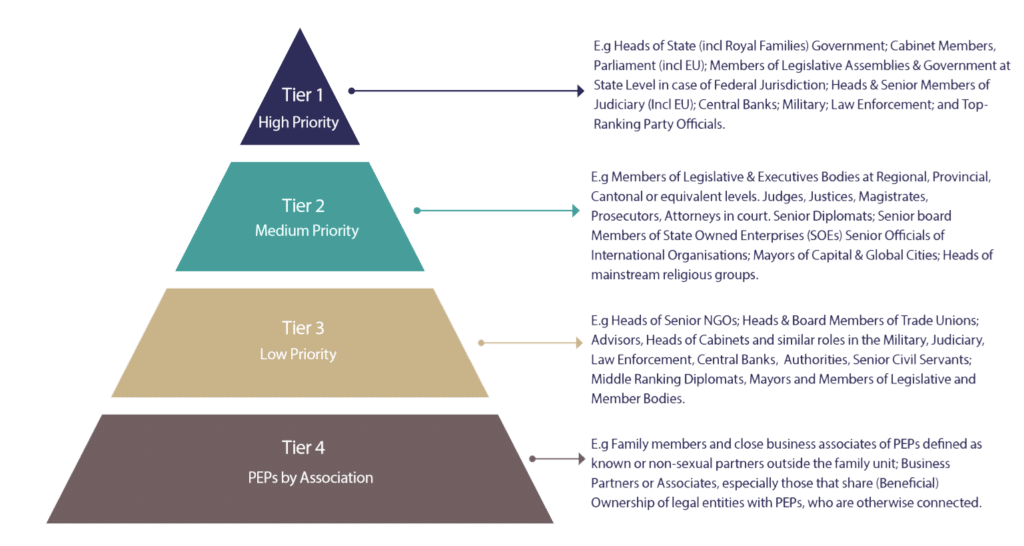

For this reason, NorthRow has a ‘PEP Tiering Guidance’ system that can serve as a framework for its to follow due diligence investigations. While several categories must be treated with care in certain contexts, the general guidelines should cover most governance systems spanning all jurisdictions in the world.

In accordance with a risk-based approach, the categories are divided into 4 different priority levels; please see the diagram below.

4 tiers of PEPs checks: What is the risk level of a PEP?

Politically exposed businesses and organisations

NorthRow also checks and monitors Politically Exposed Businesses. According to the FATF Guidance on Politically Exposed Persons, the PEP could be either the account holder or the beneficial owner of an account-holding legal entity.

If a PEP is the beneficial owner or has majority control of a company or organisation, that person may be able to use the organisation in furtherance of corrupt purposes. For this reason, FATF recommends that regulated businesses should have appropriate risk management systems to determine whether the client or the beneficial owner (BO) is a foreign PEP or has a relationship or business connection to a foreign PEP. Additionally, it recommends having measures that can provide the source of wealth and source of funds.

Similarly, for a domestic PEP and an international company PEP, financial firms are recommended to take reasonable measures to determine whether such a relationship exists and assess the degree of risk.

About NorthRow’s PEPs & sanctions solutions

NorthRow’s solution delivers the industry’s most robust AML & KYC software to help regulated firms automate the client onboarding journey whilst mitigating their business risk. Our single API includes one of the industry’s leading listings of PEPs & sanctions data.

Our approach to PEP identification and classification also maps out the relationship between PEPs and legal entities and arrangements, either directly (as director, shareholder, or similar) or indirectly (as ultimate beneficial owner), where such information is publicly known, to help establish if someone is high or low risk.

If you’d like to learn more about our solution, please get in touch with our team.

Last updated: Wednesday 29th May 2024