The UK’s Financial Conduct Authority (FCA) recently issued a ‘Dear CEO’ letter, highlighting common deficiencies in regulated firms’ anti-money laundering (AML) frameworks. Key issues include inadequate customer due diligence (CDD), insufficient risk assessments, lax ongoing monitoring, and inadequate employee training. … Read More

Author Archives: Natalie Davies

AI tops the list of biggest threats to regulated firms this year

A recent survey by NorthRow reveals that 55% of regulated businesses in the UK view artificial intelligence (AI) as their biggest threat for the year, followed by the evolving regulatory landscape (46%) and economic volatility (45%). The survey, which interviewed c-suite executives and compliance officers, also highlights that 39% of respondents see regulatory and political change as a major challenge. … Read More

The Economic Crime and Corporate Transparency Act: A guide to identity verification

In this article, we take a look at what this landmark legislation entails, the changes it will bring about, and its implications for accountancy firms in the UK. … Read More

The role of tech in improving AML processes: overcoming 5 key challenges

AML compliance faces growing challenges like manual processes, complex regulations, and cross-border transactions. Technology-driven solutions enhance efficiency, streamline due diligence, automate monitoring, and ensure compliance with evolving global requirements. … Read More

The three biggest challenges facing AML compliance teams in 2024

Our research reveals that AML compliance professionals face major challenges in resource capacity, regulatory changes, onboarding inefficiencies, and adapting to financial crime trends, requiring agility and investment in talent. … Read More

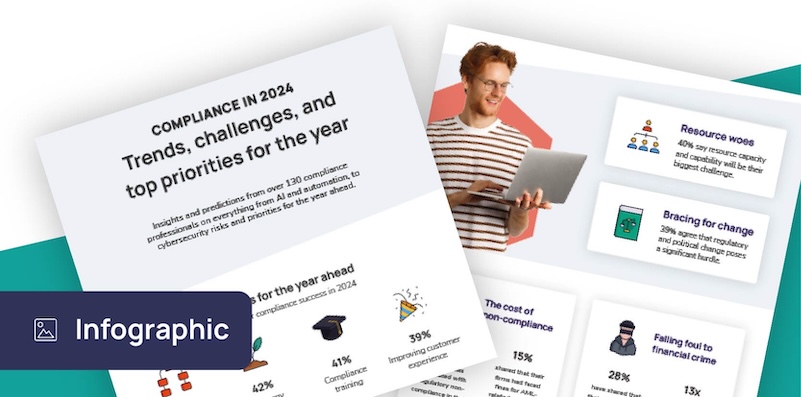

Infographic: Compliance trends in 2024

As the ever-present threat of money laundering, fraud, and financial crime continues to cast a dark shadow over entire financial systems, compliance and AML professionals continue to play a pivotal role in the war against financial crime. Did you know … Read More

3 AML compliance priorities for 2024

In 2023, professionals dealing with financial crime and AML compliance were busy handling geopolitical unrest, economic fluctuations, and evolving criminal tactics. In 2024, experts expect more regulatory changes, increased use of technology, and new methods to fight financial crime. As … Read More

State of compliance trends report 2024

Data from over 130 compliance professionals from across the country. Insights and predictions on everything from AI and automation to cybersecurity risks and priorities for the year ahead. … Read More

What can AML professionals learn from Inventing Anna?

Inventing Anna, the 2022 Netflix series, takes viewers on a rollercoaster ride through the world of financial fraud and deception. While the show is undoubtedly entertaining, it also serves as a rich source of insights for Anti-Money Laundering (AML) compliance professionals. … Read More

Unravelling financial crime in the remittance industry: The crucial role of ID&V in AML compliance

The remittance industry’s rapid growth heightens AML risks. ID&V technology streamlines compliance by automating identity checks, enhancing customer verification, and mitigating financial crimes like money laundering and terrorist financing. … Read More