Shell companies are legal entities used for legitimate purposes or illicit activities like money laundering and tax evasion. They obscure ownership, making it challenging for compliance professionals to ensure AML regulations are met. … Read More

Author Archives: Natalie Davies

Client suitability brochure

Financial brokers, banks, hedge funds, and other investment firms are obliged by law to carry out client suitability and appropriateness assessments along with full Know Your Customer (KYC) verification when trading with a range of global financial products. … Read More

Money20/20 Recap: Key Takeaways and Insights from Day 3

In the blink of an eye, we’ve arrived at the final day of Money20/20 in glorious Amsterdam. We had such a great few days at the event and the NorthRow team were on hand to talk about all things AML … Read More

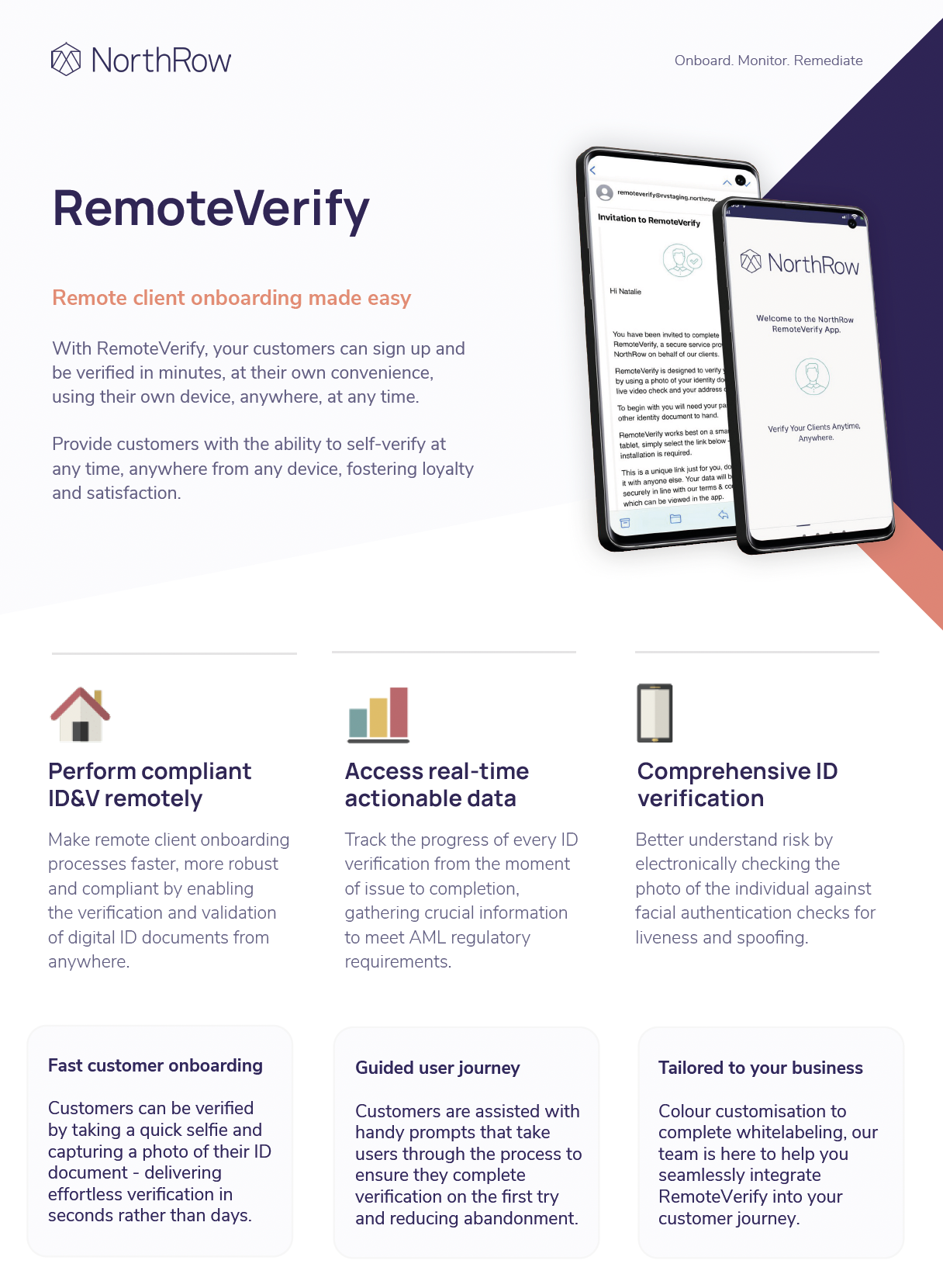

RemoteVerify brochure

Streamline your onboarding processes by verifying your clients anytime, anywhere with RemoteVerify from NorthRow. … Read More

This Month in Compliance: May 2022

Each month, we take a look at the latest compliance news and insights to keep you on top of what you need to know from across the industry. During May, an eye-opening Europe-wide report on compliance from the Council of … Read More

Understanding Your Customer (UYC): An Evolution of KYC

In the past two decades, significant advances have been made in how organisations achieve compliance with Anti-Money Laundering regulations. From huge strides in KYC technology to the sheer volume of data that is now readily available to regulated businesses to … Read More

The UK Digital Identity and Attributes Trust Framework: What is it and What Does it Mean for Compliance?

Cases of identity theft are on the increase. According to the UK’s fraud prevention body, Cifas, nearly 500 identities are stolen in the UK every single day. As such, the government wants to develop a secure digital ID service that … Read More

Client monitoring brochure

NorthRow’s client monitoring solution provides outstanding efficiency and delivers regulatory compliance. … Read More

Know Your Customer (KYC) and Know Your Business (KYB) checks: What is the difference?

Financial crime is rife. As dishonest individuals, or bad actors as we know them, develop new ways of committing economically-motivated transgressions, businesses have to ensure they keep pace in fighting their crimes. Know Your Customer (KYC) and Know Your Business … Read More

What is Money Laundering?

Money laundering involves disguising illicit funds to appear legitimate. The process has three stages: placement, layering, and integration. Anti-money laundering (AML) regulations help businesses detect and prevent such activities. … Read More