Seamless AML checks to fight fraud effectively

Anti-Money Laundering (AML) compliance software that allows you to onboard customers quickly and safely, with minimal friction, while using tailored and automated workflows to deliver regulatory compliance.

Trusted by hundreds of companies to digitally transform their compliance processes.

4.5/5

Get started today

Complete the form to request your demo

AML benefits

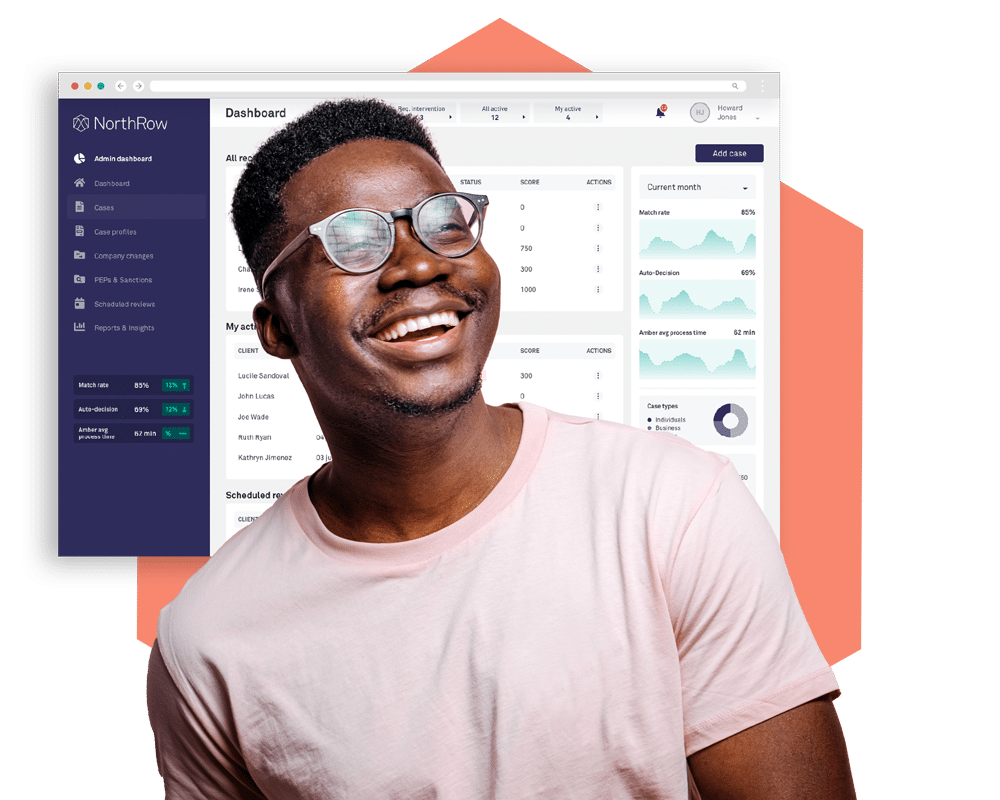

Centralise AML processes

Meet your KYC/B, CDD and EDD processes with a scalable solution that is matched to your business’ appetite for risk.

Effortless AML management

Organise, update, and secure Anti-Money Laundering records with an easy-to-use case management system for ongoing monitoring and remediation.

Stay abreast of regulatory change

Keep pace with the evolving landscape and continuous changes in AML regulations while efficiently implementing a reviewed risk-based policies approach.

Be confident in AML compliance

AML screening and onboarding

Gain unparalleled international data for identity KYC and KYB verification through a single API.

Ongoing monitoring process

Automate client monitoring to screen companies and individuals against all relevant sources seamlessly.

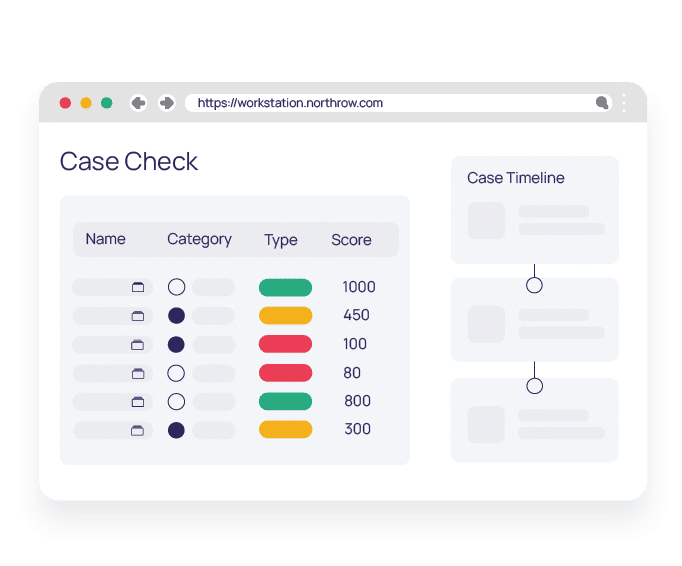

Customer Due Diligence (CDD)

Evaluate and manage risk appetites while overseeing a client's Red, Amber and Green (RAG) status.

Continuous risk-based assessment

Get instant decision suggestions based on your business' risk parameters and acceptance criteria.

PEPs and Sanctions screening

Comply with 5MLD and screen using a comprehensive global sanction and PEPs list.

AML compliance and remediation

Modernise compliance processes by automating KYC and KYB processes, creating fully auditable case records.

Review

Gather key intel for AML processes

Examine individuals and businesses for continued compliance with AML requirements, understand corporate structures, beneficial owners, PEPs, sanctions and adverse media.

DIGITISE

Automated AML compliance

Modernise compliance processes with software that automates KYC and KYB, creating a fully auditable case record and improving customer experiences at scale.

Control

Implement a risk-based approach to Anti-Money Laundering

Create an efficient AML compliance programme that streamlines workloads and delivers consistencies across the board in line with customer risk levels.

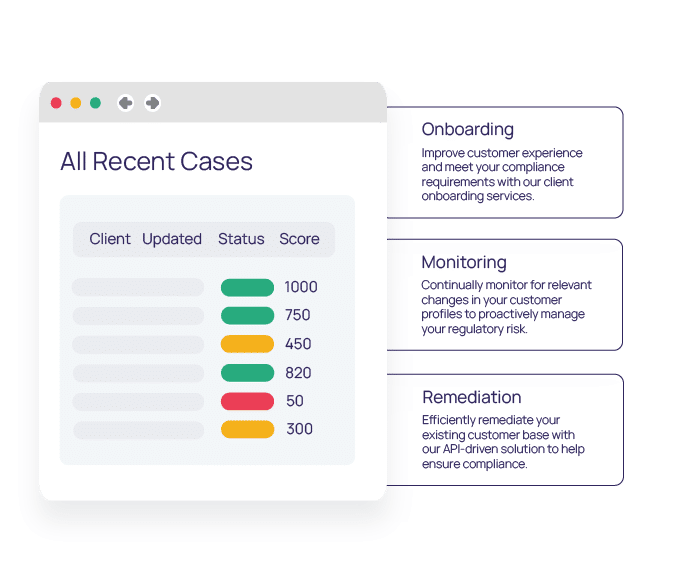

How we help

Create growth, safely through efficient AML processes

Complete peace of mind that your business is growing in a safe, compliant way by digitally onboarding customers in seconds, not days helping to create a comprehensive customer experience.

KYC and KYB Screening

Conduct comprehensive AML screening on individuals and businesses.

Case management solution

Group checks into easy-access cases with a risk rating for each portfolio.

ID&V and Right to Work

Carry out comprehensive identity and document verification checks remotely.

AML compliance

Keep track of potential risks to ensure ongoing AML compliance.

Ongoing monitoring

Automated alerts notify you of any risk profile changes to both companies and individuals.

Remediation

Meet your KYC obligations and be confident that your customer data is up-to-date.

“

“NorthRow's ability to deliver a bespoke solution that combines automated identity checks with the added security of face-to-face verification made it the obvious choice when deciding which firm to partner with to securely deliver Open Banking.”

Nigel Spencer

Open Banking

Leading Data Providers

Global individual and company data coverage

Create complete risk profiles for individuals and businesses with data from unrivalled global sources covering over 200 jurisdictions.

1,000s

Users globally

250,000+

AML checks every year

98%

Match rate

95%

Auto-decision rate

We're a government certified IDSP

NorthRow is pleased to announce it has received certification under the Department for Culture, Media and Sport (DCMS) UK Digital Identity and Attributes Trust Framework. The business is now approved as an IDSP (Identity Service Provider) for right to work checks.

Got a question?

Frequently Asked Questions

For all of your burning questions, take a look at our FAQs below. Can’t find the answer to your question? Feel free to contact us directly and we’ll be happy to help.

At present, NorthRow has a number of key data providers that it is closely coupled too. These three suppliers are used in over 90% of checks undertaken within the system.

Lexis Nexis is our core provider of UK identity and address validation data, such as credit reference agency & electoral register data.

Acuris (often referred to as C6), is our core provider of Risk data, specifically PEPs, Sanctions & Adverse media data, which is one of the most important factors our platform checks, and is used in the majority of checks within the platform.

Creditsafe is our supplier for company data. Whenever a customer looks up a company within our system, the data about that business is provided by Creditsafe

At NorthRow we take security very seriously, we adhere to the highest, rigorous standards for data, privacy and security compliance. The data you send us is only used to verify your client’s identities and businesses. We never use it for any other purpose. We send it to third parties to complete the checks, and we can share our list of sub-processors with you so that you have full transparency of how your data is used.

Our products are tested continuously throughout our development process by a team of internal QA engineers. In addition to the application testing we regularly scan for vulnerabilities using third party services and undertake annual detailed penetration testing. We continually monitor new vulnerabilities and proactively work to ensure that we are protected.

We host our services within the EU on Amazon Web Services. The data is encrypted in transit and at rest using AES-256 keys. Almost all of our sub-processors are also hosted within the EU. However, we will advise you if you need a service that is not based in the EU.

NorthRow makes use of the Amazon Web Services and Microsoft Azure to ensure we do not have a single point of failure in our architecture. All the data we hold and the services we provide are backed up at regular intervals to protect against disruption or loss of data.

From the moment we work together, we hold your hand throughout the implementation process and continue through to ‘go live’.

Excellent customer service and continued support are all part of partnering with NorthRow. You can always email our support team at support@northrow.com if you have any queries.

All customers receive a dedicated account manager who will keep in touch to ensure you get the most out of our software.

Typically, we get our clients live within 14 days of them signing a contract.

What we do →

Understand how NorthRow can help you confidently onboard customers, manage risk and be compliant.

Why NorthRow →

How NorthRow ensures continued AML compliance in the most automated, efficient and accurate way possible.