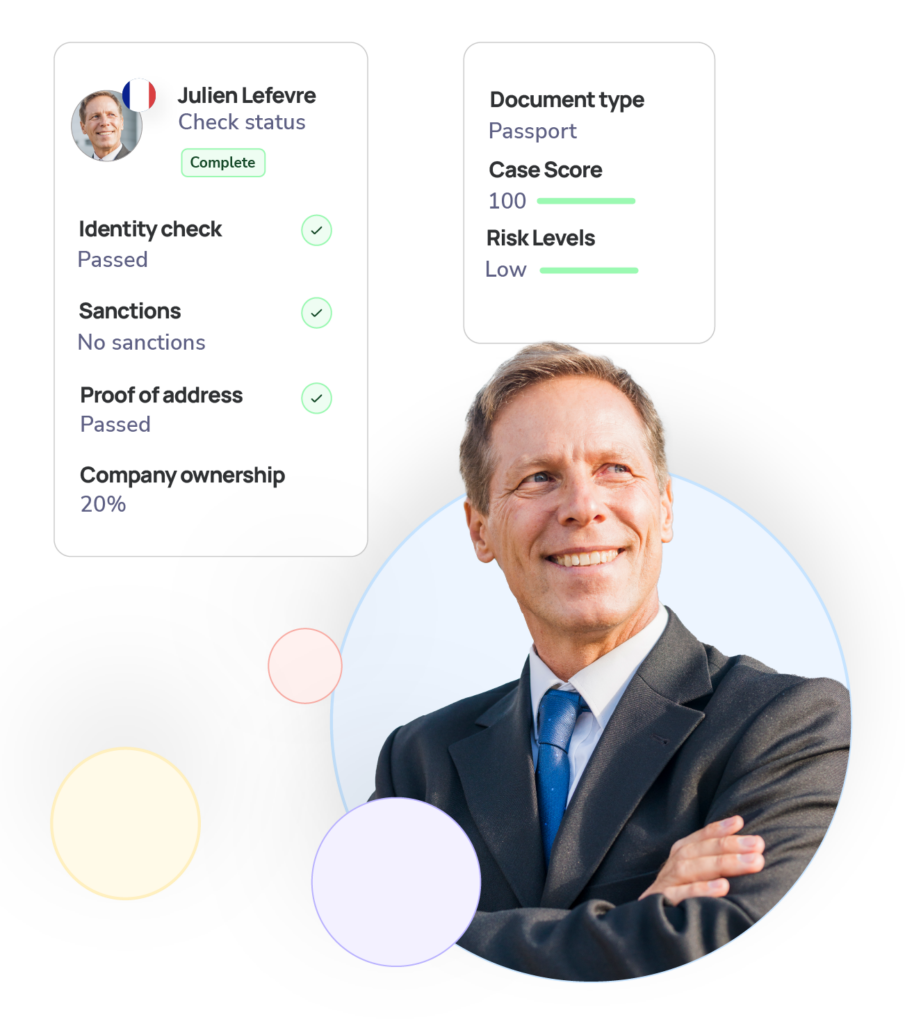

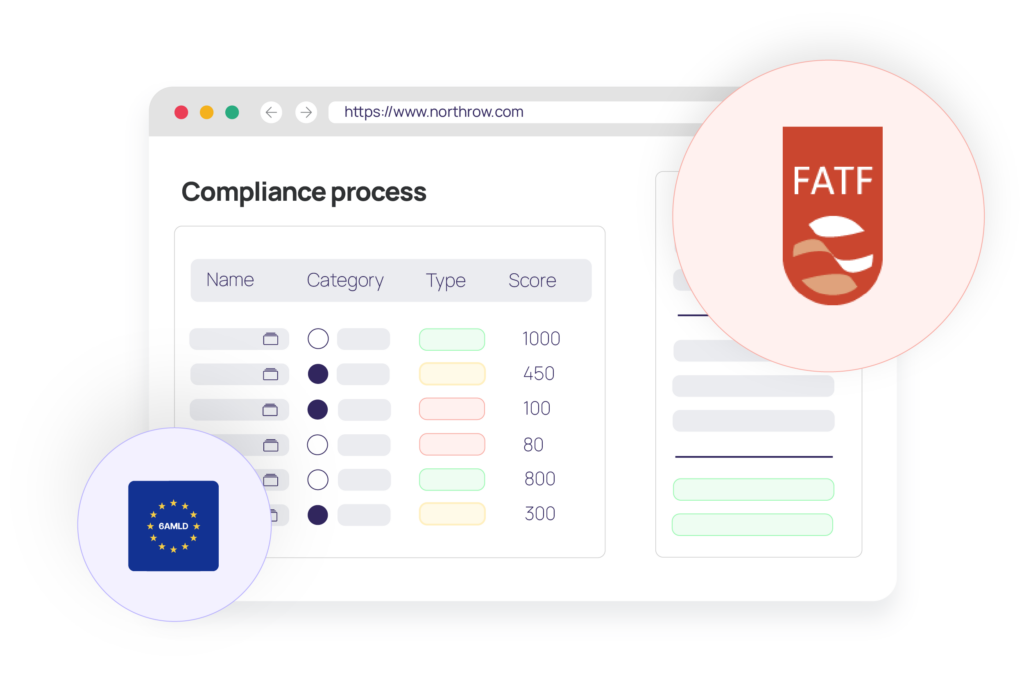

AML compliance software

Seamless AML checks to fight financial crime.

Simplify complex AML compliance processes to onboard customers quickly and safely, with minimal friction to meet evolving regulatory standards.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive