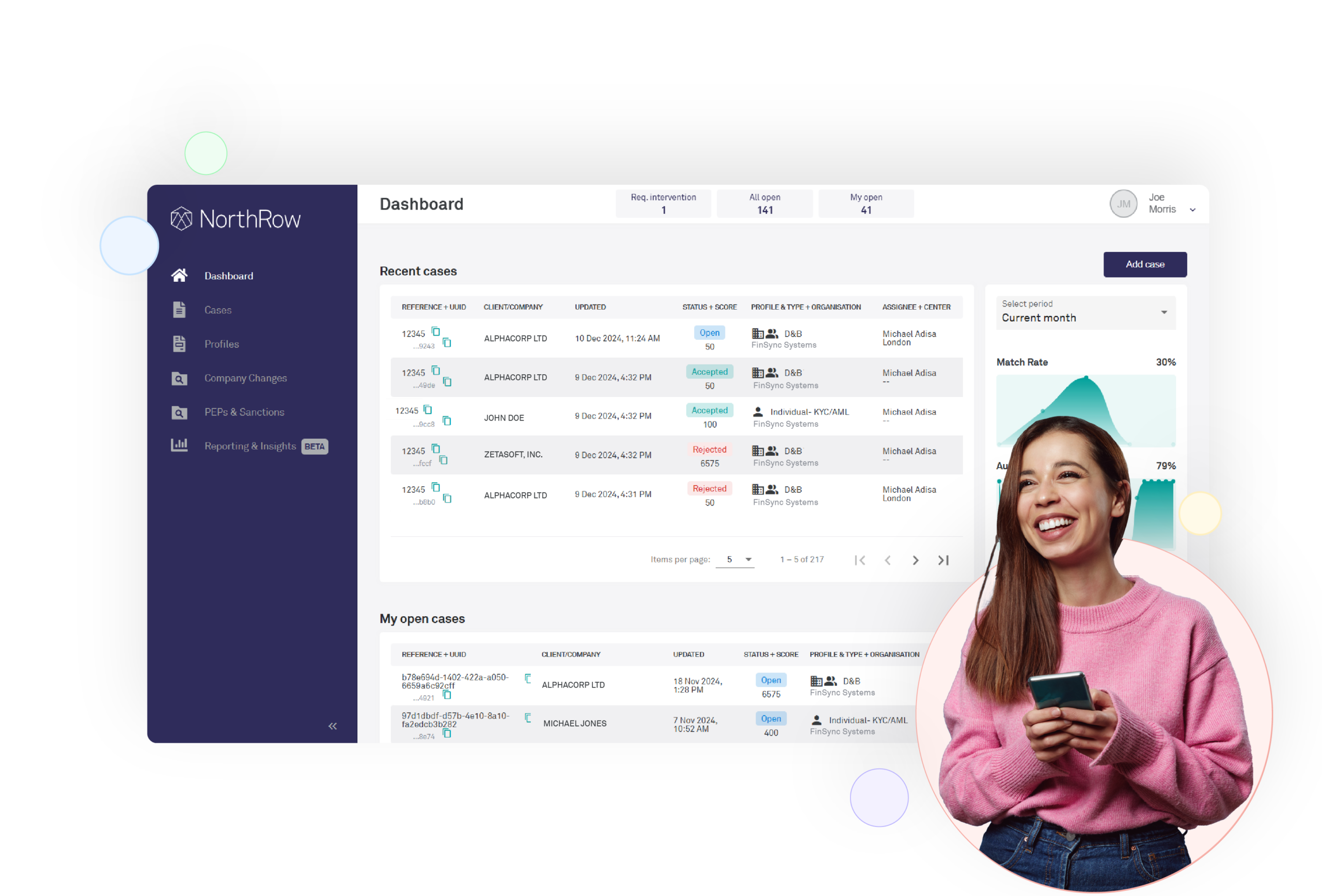

Do you really know who you’re doing business with? We do.

Simplify, accelerate, and verify complex corporate structures by identifying ultimate beneficial owners in seconds, not days ensuring your business stays safe and secure.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive